Complete Guide to Bank Reconciliation + 5 Steps Involved

.webp)

What is Bank Reconciliation?

Bank reconciliation is the process that helps you ensure your company's accounting records match your bank statements. It's a core account reconciliation and a way to double-check that the money you think you have matches what's in your company’s bank account. This process is crucial for performing accurate financial reporting and managing cash flow effectively.

Types of Bank Reconciliation

Bank reconciliations can be classified into two main types: month-end and ongoing.

Month-end Bank Reconciliation

As a key part of the balance sheet reconciliation process, month-end bank reconciliations are performed at the end of each month to ensure that all bank transactions for the period are accounted for. This process involves matching the bank statement with the company's general ledger account balance, identifying discrepancies, and making necessary adjustments. We’ll dive deeper into how to perform this recon below.

Ongoing Bank Reconciliation

Ongoing bank reconciliations are conducted more frequently, such as weekly or even daily, to maintain real-time accuracy in financial records. These reconciliations typically involve live transaction matching between an accounting system and a live feed from a financial institution, and reduce the risk of errors and fraud.

Why is Bank Reconciliation Important?

The bank reconciliation process plays a pivotal role in producing accurate financial statements as well as establishing solid cash flow management. By understanding and implementing bank reconciliation, you can keep polished financial records, detect any bookkeeping discrepancies, and ensure that your recorded cash balances are precise.

- Pinpointing Cash Flow: Bank reconciliation ensures you have a precise understanding of the money flowing in and out of your accounts. Knowing your exact cash position helps you make informed decisions, whether it’s paying a vendor or investing in new equipment. Without reconciliation, you might assume you have more or less money than you actually do, leading to poor financial decisions.

- Highlight Fraudulent Activity: Regular bank reconciliation helps detect discrepancies that may indicate fraud. For instance, if you notice a check amount that doesn’t match the recorded amount in your books, this could be a sign of tampering. By catching these issues early, you can take corrective actions before they escalate.

- Accounts Receivable Management: No one wants to leave money on the table – unpaid invoiced impact your entire order to cash process, which in turn affect your company revenue. Regular reconciliations help to spot invoices that haven’t been paid. Once identified, you can take steps to collect the payments, such as sending reminders or contacting the customer directly. Addressing these problems promptly ensures that your business maintains a healthy cash flow and reduces the risk of bad debts.

How to Do Bank Reconciliation: 5 Key Steps

Step 1: Compare Balances

Begin by aligning the bank account balance with the cash balance on your company’s balance sheet. Have both your bank statement and your cash balance side by side. The balances will rarely match exactly, so don't be alarmed.

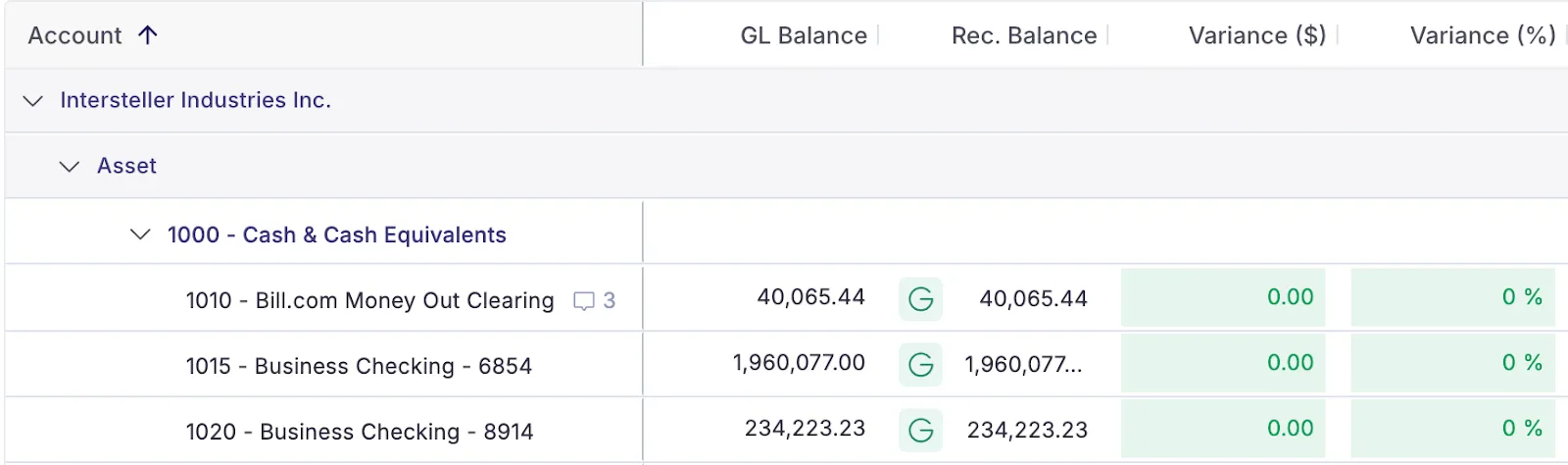

If using Numeric, AI will scan and pull the balance from any uploaded bank statements to compare directly against the GL total. These balances sit side-by-side in your auto-generated reconciliation report each month.

Step 2: Review Bank Statement

Next, dive into your bank statement to find transactions not yet reflected in your company’s books. Look for items such as bank fees, wire transfer fees, and interest income. These transactions might not have been recorded in your books yet because they occurred after your last update. Note these discrepancies for the next steps.

Step 3: Review Account Trial Balance

Now, turn your attention to your recorded cash balance and identify transactions recorded in your books that don’t appear on your bank statement. Two common examples are:

- Outstanding Checks: these are checks you’ve issued but the recipients haven’t cashed yet

- Deposits in Transit: these are deposits you’ve recorded in your books but haven’t yet been processed by the bank.

Make a list of these items as they will need to be accounted for to reconcile the balances.

Numeric’s deep Netsuite integration gives teams access to transaction-level details across their accounts; this makes bank recons easier as you can pull up & pivot transactions directly in the Numeric platform.

Step 4: Adjust Balances

Once you’ve identified the discrepancies, make any necessary adjustments. This step ensures your records accurately reflect your financial status.

- Adjust GL Bank Account Balance: Adjust the bank account balance for outstanding transactions identified in the previous step. Calculate how the balance will change once these transactions are processed. For example, if there are $5,000 in outstanding checks, subtract this amount from the bank balance. If there are $2,000 in deposits in transit, add it to the bank balance.

- Adjust Book Balance: Add or subtract bank transactions that haven’t been recorded in your books but appear on your bank statement. For instance, if there is a $50 bank fee, subtract it from your book balance.

Step 5: Record the Reconciliation

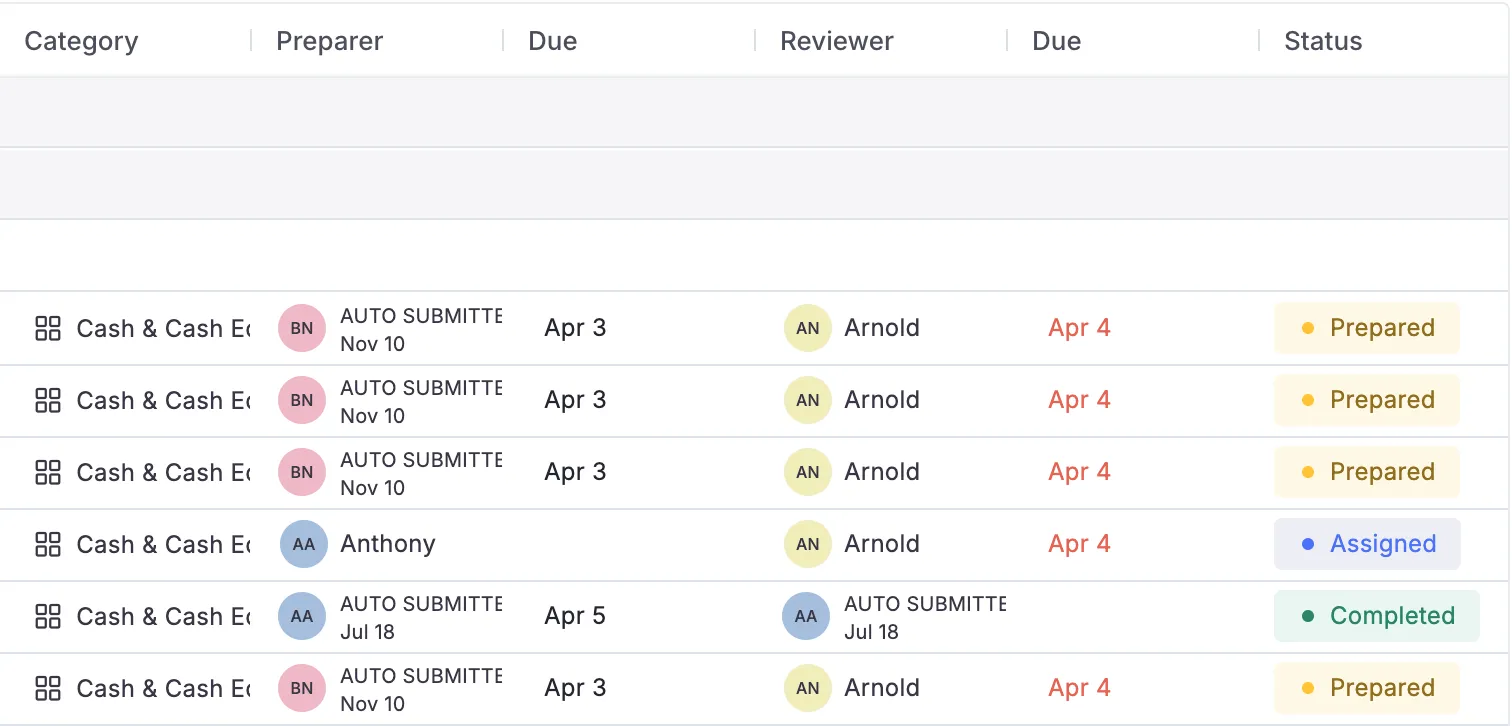

Finally, document the entire reconciliation process, at a minimum capturing who prepared and reviewed the reconciliation and when. This statement should itemize every discrepancy, showing the date, amount, and reason for each adjustment. Proper documentation ensures that you maintain a clear record for future reference and auditing purposes.

Numeric eliminates the busywork from documentation by automatically recording when a reconciliation has been reviewed and completed, along with any associated comments.

Real-World Example for Reconciling Bank Statements

John Franklin is a staff accountant for the computer hardware company, ABC Widgets, who has been tasked with reconciling the company’s cash accounts for month-end.

When he receives the bank statement for one of the business accounts, a checking account, he sees that it has an ending balance of $9,800 while the company’s book balance shows $10,500. Here’s how John can reconcile these differences.

- Compare Balances: In looking at the trial balance for the bank account and the bank statement balance, John sees that there is a difference of $700.

- Review Bank Records: When John checks the bank statement, he sees that the account accrued $50 in interest earned and that the bank issued a service fee of $300. While these charges are documented in the statement, they aren’t reflected in the books.

- Review Book Records: John looks into the company’s records to initially check for two things: outstanding checks and deposits in transit. some text

- Identify Outstanding Checks: John first checks to see if checks have been recorded in the books but not yet cleared by the bank. He sees two outstanding checks: Check #201 for $300 and Check #223 for $150. They amount to $450.

- Locate Deposits in Transit: John sees that ABC Widgets made a deposit of $900 on the last day of the month, which hasn’t cleared yet.

- Adjust Balances: To remediate these discrepancies, John makes adjustments to each balance. some text

- GL Balance: He adds the $900 of deposits in transit and subtracts the $450 of outstanding checks from the general ledger balance of $9,800 to arrive at an adjusted bank balance of $10,250.

- Trial Balance: He subtracts the $300 of bank fees and adds the $50 of interest earned to the book balance of $10,500 to arrive at an adjusted book balance of $10,250.

- Record the Reconciliation: After completing the adjustments, John creates a bank reconciliation statement listing all balances before and after the reconciliation, as well as all updated journal entries. In doing so, he ensures that the financial records are up-to-date and will align appropriately with the next period’s reconciliation.

Common Challenges with Bank Reconciliation

Uncleared Checks

Uncleared checks are checks that have been issued but not yet cashed by the recipient. These can create discrepancies between your bank statement and your cash book. For example, if you issue a check to a supplier at the end of the month, it might not clear until the following month.

To adjust for uncleared checks during bank reconciliation, list all issued but uncleared checks, subtracting their total from your bank statement balance. Ensure to track these checks until they clear or are voided.

Returned Deposited Checks

Checks may be returned for several reasons, such as insufficient funds (NSF), a closed account, or a stop payment order placed by the issuer.

To reconcile returned checks, deduct the amount of the returned check from your cash book. Also, note any bank fees associated with the returned check. Update both the cash book and the bank statement to reflect these changes.

Bank Service Fees and Interest Income

Banks often issue service charges for various services like wire transfers or account maintenance. Conversely, you might earn interest on your bank balance. Together, these fees may not be immediately recorded in your cash book. To reconcile them, deduct any service fees from your book balance while adding any interest income.

Reconciling Voided Checks

Voided checks are those that should not have cleared but somehow appear as debits in your bank statement. This can throw off your balance calculations. In these cases, contact your bank to correct these errors and adjust your cash book to reflect the correct balance. Document the voiding process to prevent future mistakes.

Best Practices for Bank Reconciliation

Performing Reconciliations on a Set Schedule

Consistency is key. Regular reconciliations prevent discrepancies from accumulating. Aim to reconcile your bank statement at least once a month. Some businesses, particularly those with high-volume financial transactions, may benefit from weekly or even daily ongoing reconciliations. This practice ensures any errors or fraudulent activities are caught early.

Leveraging Technology for Automation

Automation can significantly streamline bank reconciliation by cutting down on time-consuming manual tasks and minimizing errors.

For teams looking to move away from a manual reconciliation process, close automation accounting software is key. Since Numeric can automatically pull a company’s trial balance and totals from bank statements, teams automate much of the reconciliation process and can auto-submit recons that are below the materiality threshold.

Detailed Documentation

It’s imperative to maintain detailed sets of records of the current reconciliation process and any adjustments made. Proper documentation is vital for transparency and accountability. Each step of the reconciliation process should be clearly recorded, including any discrepancies found and the actions taken to resolve them. This practice not only aids in internal reviews but also provides an audit trail.

Key Terms for Bank Reconciliation

Outstanding Check

An outstanding check is a check that has been written and recorded in the cash book but has not yet been cleared by the bank. This means the money has not been deducted from the bank account.

NSF Check

NSF stands for "Non-Sufficient Funds." An NSF check is a check that a company tries to deposit but the payer's bank returns it because there aren't enough funds in the payer's account.

Deposit in Transit

A deposit in transit is money that has been received and recorded in the cash book but has not yet been processed by the bank. This usually happens when deposits are made after the bank’s cut-off time.

How Numeric Helps Accounting Teams with Bank Reconciliation

- Stay on top of month-end bank reconciliations with AI scanning of bank statements: For month-end bank recs, teams can pull account balance totals automatically from their bank statements with AI and the trial balance from their GLs. To add, prior period balance monitoring catches any changes since accounts were reconciled.

- Stay organized and audit-ready with clear controls and documentation: Numeric makes it easy to assign tasks to preparers and reviewers, and keeps track of all comments, changes, and submissions in a clear month-end close checklist. When audit time rolls around, auditors can log straight into Numeric and see a complete activity trail, no need for your team to spend hours resurfacing required documentation.

The Bottom Line on Bank Reconciliation

Ultimately, bank reconciliation is a relatively straightforward accounting process that is essential for understanding a company’s cash position. Companies that stay on top of bank reconciliation not only keep their accounts in check but can also strengthen their overall financial strategy.

.png)

.png)