FloQast or BlackLine: Which is better?

.webp)

FloQast and BlackLine are two of the three main players in the monthly financial close software space.

In this article, we compare FloQast vs. BlackLine to help you decide if they are the best fit for the accounting needs of your team.

We’ll explore how these two tools work, what features and integrations they offer, what plans are available, how pricing works, how effective customer support is, and what existing customers think about the two platforms.

FloQast & BlackLine: What They Do

FloQast and BlackLine are cloud-based financial close management software tools that help companies manage, streamline, and automate the monthly close process. These two platforms, along with Numeric, are considered the three key players in the financial close software market.

While FloQast and BlackLine are generally strong products that help facilitate and optimize monthly close and are liked by some companies, they come with certain disadvantages too.

Specifically, BlackLine is typically a good fit for large-scale, often public companies and international organizations that have dedicated staff but can prove too complicated or overwhelming for small teams.

Meanwhile, FloQast is a good option for companies that want to focus on accounting task management basics and still want to centralize much of their operations in excel, but has somewhat limited features for teams with more sophisticated needs.

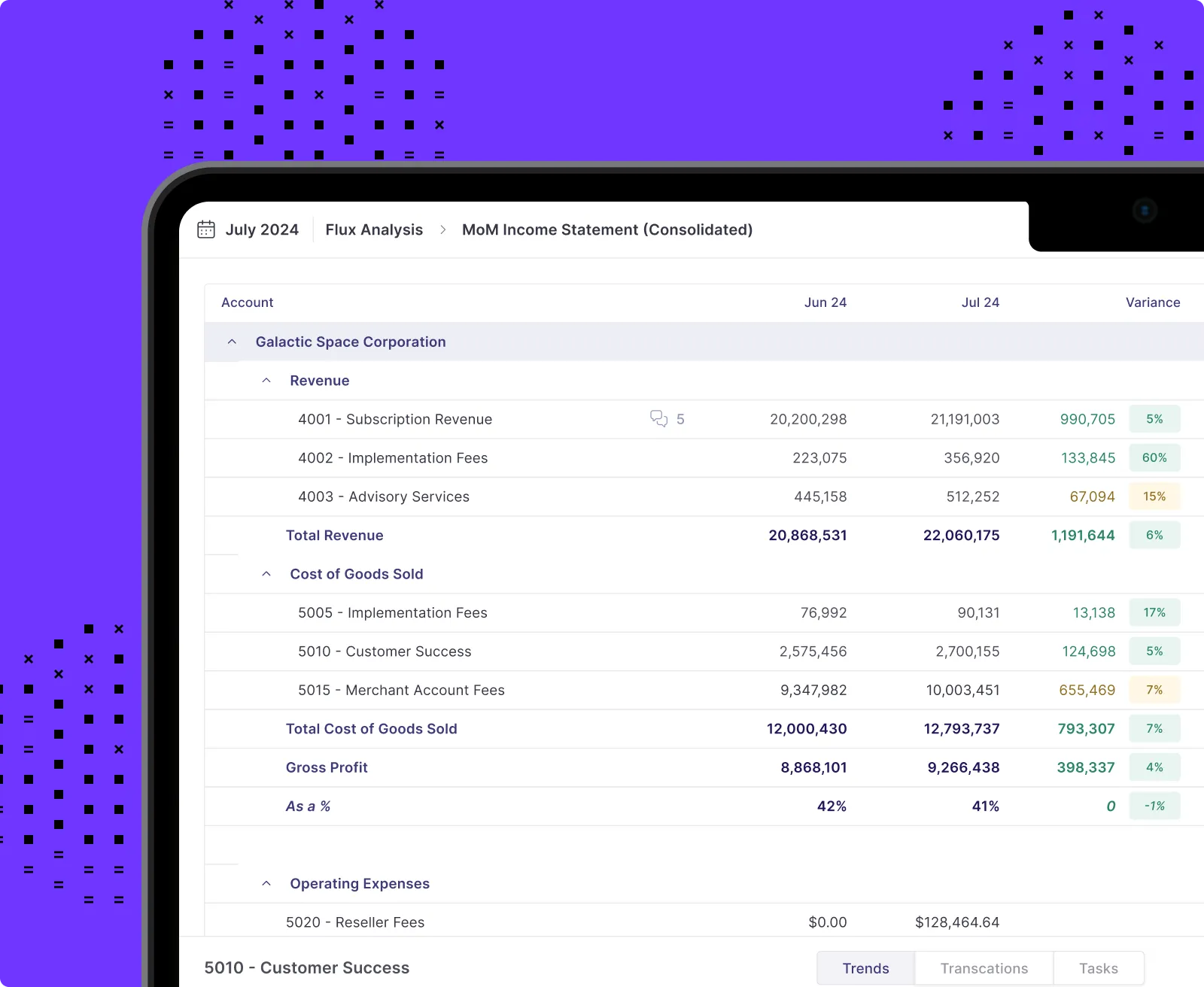

Numeric, a FloQast and BlackLine competitor, strikes the right balance between comprehensiveness and flexibility with ease of implementation. With a fast, modern interface, Numeric is powerful, but not overpowering.

BlackLine vs FloQast: How It Works

As accounting task management tools, the value of both products is that they help teams keep all processes and documents related to the monthly financial close in one place, well organized, and easily findable with internal controls.

In a way, FloQast and BlackLine work like the Trello or the Asana of the accounting industry. But they go a step further from task management by also introducing automated accounting process workflows involved in monthly close, including account reconciliation and flux analysis.

Getting started with FloQast and BlackLine accounting software looks very similar and requires the following main steps:

- Set up task management specific to the monthly close process

- Integrate the platform with your ERP and connect it to supporting workpapers

- Configure workflows

While customers tend to find the FloQast implementation process to be generally smooth, they report a resource-intensive set-up process with BlackLine.

On average, getting started with FloQast requires about 1.3 months, and getting started with BlackLine takes over 4.5 months.

BlackLine reviews by customers occasionally focus on the long and complicated implementation and the need for dedicated staff for successful set-up and use. Much of the implementation complexity is the result of being able to customize to your company’s needs—an important tradeoff to consider when evaluating close management options.

FloQast, meanwhile, focuses more narrowly on task management for the close and therefore has a faster typical implementation timeline. The implementation of both FloQast and BlackLine is performed with support from their respective customer service teams, and both companies typically charge implementation fees.

FloQast vs. BlackLine: Features

As leading month-end close management tools, there is a lot of overlap in the features provided by FloQast and BlackLine. Still, there are some significant differences that accounting teams need to take into consideration when choosing between the two options.

FloQast Features

FloQast Close provides these functionalities:

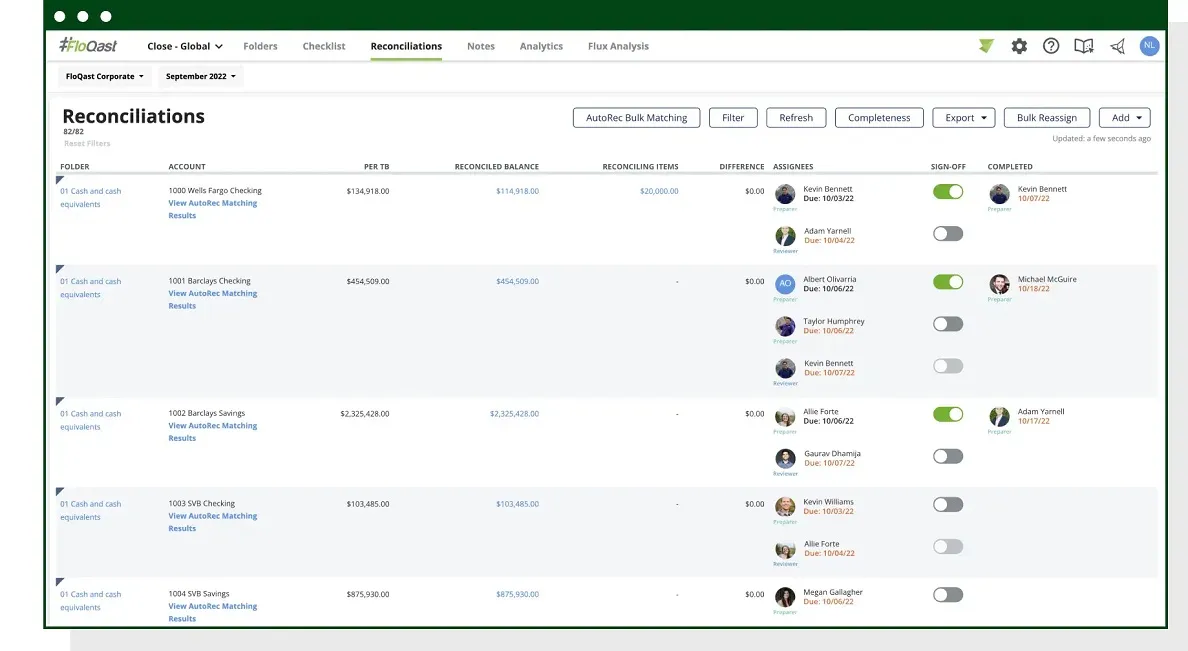

- FloQast Reconciliation Management: In addition to providing a centralized view of each account’s reconciliation status, this tool also sends automatic notifications to review items and detects unexpected out-of-balance conditions.

- FloQast Variance Analysis: FloQast improves flux and budget variance analysis through the automation of data collection and sign-off processes.

- FloQast Analyze: This feature provides all involved players with visibility into the financial close process.

- FloQast Compliance Management: FloQast allows for business-integrated controls to boost the compliance program.

- FloQast ReMind: This feature allows you to use available templates or create your own to automate different reminders.

All in all, the FloQast close product focuses primarily on enhancing task management and providing full visibility across the entire team. This is achieved through features such as automated alerts, reminders, notifications, and CFO summaries of tasks.

This relative simplicity in features and functionalities, compared to BlackLine, makes FloQast the easier to implement financial close management software solution.

BlackLine Features

BlackLine Financial Close Management gives access to the following tools and features:

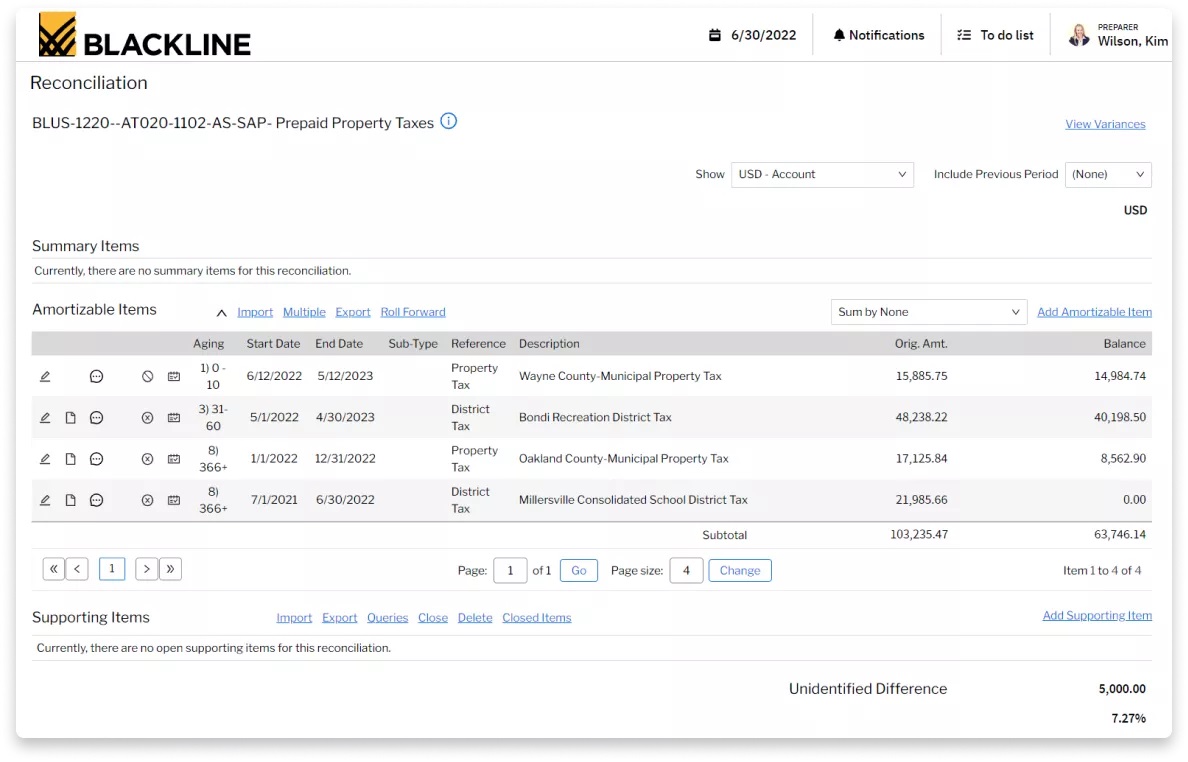

- Account reconciliation: BlackLine account reconciliation offers standardized templates that can be further customized for reconciliation between workpapers and your GL, risk-based workflows, and auto-certifications below pre-set thresholds.

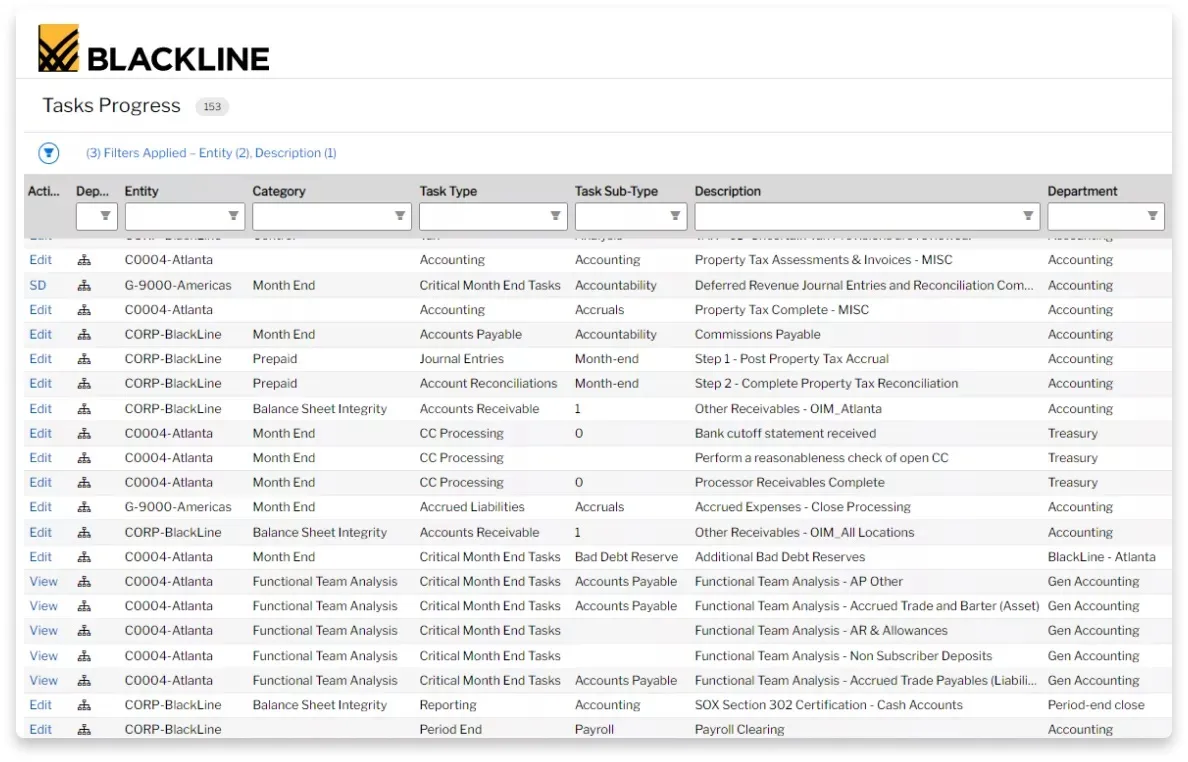

- Task management: Your team members can collaborate on the monitoring, tracking, and certifying of various financial and accounting tasks.

- Transaction matching: This feature allows the automatic reconciliation of numerous transactions so that you can focus on the exceptions.

- Journal entry: BlackLine helps with the management, automation, and centralization of journal entry processes and retaining supporting documents in the cloud.

- Compliance: This feature supports the execution of control workflows to proactively identify risks and manage them.

- Variance analysis: BlackLine automates the calculation and identification of fluctuations in balances and activities to monitor risk.

- Smart close: The BlackLine platform helps schedule and execute tasks, monitor variances, and verify outcomes to streamline and automate activities in SAP.

- Consolidation integrity manager: You can set up business rules and hierarchies to streamline system-to-system reconciliations and map GL accounts to consolidation.

- Account analysis: BlackLine allows for the automation of the examination of high-volume, high-risk accounts at the transaction level.

- Financial reporting analytics: Teams can streamline and automate the analysis of financial statements through real-time transparency.

Compared to FloQast, BlackLine features provide more ample opportunities for automations, like automated journal entry tracking, for example, and you can mark tasks as dependent on others. Moreover, the product expands beyond financial close management and helps with other accounting and financial tasks. Thus, BlackLine close management could be a good fit for entities that already use other BlackLine products, such as accounts receivable automation and intercompany financial management.

However, these more comprehensive features come with more complicated implementation and set-up and ongoing maintenance for admins.

FloQast vs. BlackLine: Integrations

When choosing the best-fitting close management software for your company, it’s important to know what tools and systems it integrates with to ensure that it will enhance rather than obstruct your accounting and business processes.

FloQast Integrations

FloQast integrates with the major ERPs:

- Intuit Quickbooks

- Sage Intacct

- Oracle NetSuite

- SAP

- Microsoft

- Infor

FloQast also provides integrations with:

- Collaboration tools: Microsoft Teams and Slack

- Cloud storage platforms (to connect directly with existing spreadsheets): Google Drive, Microsoft OneDrive, Dropbox, Microsoft SharePoint, Box, and Egnyte

- Workflow systems: Workiva

BlackLine Integrations

BlackLine works with a long list of both big and small ERPs including:

- Intuit Quickbooks

- Sage Intacct

- Oracle NetSuite

- Accounting

- AS400

- Banktel

- Cobalt

- CostPoint

- Deacom

- Deltek

- Dynamics SL

- Epicor

- Filosoft

- Fiserv

- Flexi

- Homegrown

- Infineon

- Infinium

- Infor GEAC

- Infor LN (Baan)

- Infor Lawson Fixed Assets

- Infor Lawson General Ledger

- Infor Lawson Project Accounting

- Jack Henry

- Ledger

- MAS500

- McKesson

- Metavante

- Microsoft Dynamics AX, GP, NAV, SL

- Oracle Hyperion HFM

- Oracle Hyperion Essbase

- Oracle A/P

- Oracle A/R

- Oracle Cash

- Oracle Fixed Assets

- Oracle General Ledger

- Oracle JDE

- Oracle Project

- Outlook Soft

- Pathways

- PeopleSoft Fixed Assets

- PeopleSoft General

- PeopleSoft HR

- QAD General Ledger

- SAP BPC

- SAP BW

- SAP Fixed Assets

- SAP General Ledger

- SAP Open Items

- Scala

- Workday

- Yardi

FloQast vs. BlackLine: Plans

FloQast and BlackLine run SaaS pricing models with annual subscription fees. Both products offer customizable plans to meet the needs of teams with diverse needs, from various industries, and of different sizes.

FloQast Plans

Third-party sources point out that FloQast offers three different subscription plans that mostly depend on the features and tools that users want to access. The plans are further customizable according to the required number of users and are charged annually.

Generally, FloQast charges an implementation fee and a yearly subscription fee.

BlackLine Plans

Similarly, different BlackLine plans provide access to various tools and allow a different number of users. In addition to an annual subscription fee, customers should be prepared to pay implementation fees, configuration fees, and, at times, ongoing professional services fees.

FloQast vs. BlackLine: Pricing

Neither FloQast nor BlackLine provides pricing details on their websites.

FloQast Pricing

Overall, FloQast tends to be the more affordable option of the two for mid-market companies, depending on the access to tools and the number of users. The main cost includes an annual subscription fee. There is no free trial and no free version regardless of the needs and the size of your team, making it out of reach for some small businesses.

BlackLine Pricing

Typically, BlackLine ends up being more expensive than FloQast, which can be a drawback of the product. This makes it a generally good fit for larger companies with bigger budgets and more complicated accounting needs, as well as dedicated staff. Similar to FloQast, BlackLine does not offer a free trial or a free plan.

The BlackLine pricing model includes a number of different one-time and recurring fees and can include the following costs:

- Implementation/set-up cost

- Configuration & customization fees

- Integration fees

- Data migration costs

- Annual subscription fees

- Administrative services fees

- Training and education costs

Given no exact pricing information is provided on the websites of the two companies, to get an estimate of the cost you can expect with FloQast vs. BlackLine, you can:

- Schedule a demo and ask about pricing

- Contact a sales representative online or by phone

- Inquire on online accounting forums

- Ask a fellow controller or accounting manager

FloQast vs. BlackLine: Customer Support

The availability and quality of customer support is crucial for the successful use of a financial close management software both during and post implementation. So, let’s take a look at the customer services that FloQast and BlackLine offer to their new and existing clients.

FloQast Customer Support

Based on online reviews, customers are generally satisfied with the ongoing support provided by FloQast.

As part of Customer Success, FloQast delivers:

- Implementation services: FloQast offers personalized services and consultations to speed up the implementation process and boost the onboarding journey.

- Training and education: The FloQademy is an online learning portal which provides free access to product and non-product professional courses.

- Product support: FloQast has a network of product support specialists available to customers 24/7.

- Accounting success management: Customers get assigned a dedicated FloQast Accounting Success Manager (ASM) to improve software adoption and utilization.

Customers can improve their accounting skills and benefits from using the FloQast product through:

- The FloVerse Community: The customer community helps clients connect with other FloQast users and learn from them.

- The FloQast Blog: This includes blog posts dedicated to FloQast features.

- Webinars: FloQast organizes regular webinars to cover key accounting topics and how their product helps with common issues.

Customers can get in touch with FloQast customer service via an online contact form available on the company website or by phone.

BlackLine Customer Support

BlackLine offers multiple venues of customer support during and after set-up.

The customer services provided by BlackLine include:

- Professional services: The company offers pre- and post-implementation services to ensure that the platform has been properly set up and teams are achieving their business goals.

- Training and education services: BlackLine provides training solutions to help companies optimize the returns on their investment.

- Customer success services: Additional resources include workshops, webinars, and user groups that offer coaching, guidance, and advocacy.

- Administrative services: These are structured management services that focus on supporting BlackLine configurations after implementation.

- Transformation services: These services supply different levels of engagement to help companies achieve automation and optimization, including the BlackLine Optimization Academy.

- Support services: Customers get access to expert support when needed.

When working with BlackLine, customers can use the following additional resources:

- The BlackLine Community: The customer community functions as a hub of insights and information provided by users, partners, and experts.

- BlackLine Magazine: The BlackLine blog offers articles on both general accounting topics and product-specific subjects.

- Consulting Alliance Partners: BlackLine partners with leading advisory and consulting firms to create value for joint customers.

- Webinars: On-demand webinars complement the knowledge offered through the company blog.

- Product Support: Product Support is offered at different tiers (Essential, Enhanced, and Elite), depending on your team’s needs and budget.

Customers who have questions can contact BlackLine by filling in an online form on the company website or by phone.

While BlackLine customer support seems comprehensive, note that some of the services are provided for a fee.

FloQast vs. BlackLine: Reviews

Both tools have a strong online reputation with generally positive customer reviews.

FloQast Reviews

In their online reviews, most customers have given FloQast 4 or 5 stars.

- G2: 4.7/5 stars

Happy customers mention the accounting system synchronization, the enhancements to the monthly close process the tool offers, the implementation, the reliable processes, the quarterly check-ups from the customer service team, and the available customer support.

Less happy customers discuss the limited control environment, difficulties in ensuring uniformity across entities, the few integrations, and the potentially high cost.

BlackLine Reviews

The majority of customers have rated BlackLine with 4 or 5 stars.

- G2: 4.5/5 stars

Some positives that existing customers highlight are the accounting-function focus, the matching system, the minimized manual transactions, the data centralization, and the automation of reconciliation and the financial close.

Other customers find challenges with the complicated implementation and use that require dedicated staff, the inability to streamline work processes, and the slow and at times buggy platform.

FloQast vs. BlackLine: Bottom Line

In conclusion, our FloQast vs. BlackLine comparison shows that, out of the two, in most cases for teams that just need accounting task management basics, FloQast is the better fit. BlackLine, on the other hand, is a great fit for large-scale, public companies that prioritize power, automation, and flexibility, and are comfortable with the corresponding higher price and more complex implementation and interface.

Meanwhile, Numeric is the best product in the market both for teams that need the basics to get started and for those that want access to power and flexibility without sacrificing ease of use.

Given the best software depends largely on your specific company context, it’s best practice to demo several options, like FloQast, BlackLine, and Numeric, to compare functionality and price ahead of making a decision.

.png)

.png)

.png)