Month-End Close Benchmarks: Where Does Your Close Rank?

.webp)

How soon do you want your month-end close to finish? In a week? Tomorrow? Yesterday?

Everyone wants to close faster, but what is 'fast' anyway? How long should your month-end close take, ideally?

According to Ventana Research’s survey in 2022, a month-end close should take three to six business days. However, don't worry if your close on average takes longer.

This study has plenty of nuances you must note before using it as a benchmark.

For example, for small teams, it’s more common to aim for a close in 10 business days (2 weeks).

In this article, we look at a few month-end close timeline benchmarks and explore how to accelerate it in your company’s context.

Related Reading: Learn how you can build a month-end checklist that aligns teams and reduces your time to close.

How Long Does a Month-End Close Take?

If you're wondering how long a month-end close should take, the answer is a frustrating 'it depends.'

A big reason for this is the lack of clarity around what constitutes a "Close." Smaller accounting teams often reconcile just a few key accounts like accounts payable and accounts receivable with Excel and their general ledger and do not conduct a flux analysis, considering this a full month-end close.

As companies scale, their close checklists grow with more accruals, prepaids, fixed assets with depreciation schedules, etc. which extends timelines. Then, at some stage, accounting staff and tech available scale at pace to match the uptick in accounting complexity, close timelines decrease or stay constant despite the task volume.

These dynamics make benchmarking month-end close timelines challenging. Currently, we have just two influential studies that benchmarked them.

APQC's Cycle Time to Monthly Close

Publications often cite The American Productivity and Quality Center's (APQC) 2017 General Accounting Open Standards Benchmarking survey as a benchmark for month-end close cycles.

APQC measured the "Cycle Time to Monthly Close"—defined as the cycle time in calendar days between running the trial balance to completing the consolidated financial statements— in 2,300 organizations. Here we assume the definition of a close includes the full list of typical month-end tasks, bank reconciliation with bank statements, credit card reconciliations, verifying financial transactions and expense accounts in the core accounting system and spreadsheets, and relevant data entry.

The study cited six calendar days as the median Cycle Time to Monthly Close, which given the large sample size, is fairly credible.

However, the study is now almost seven years old and largely happened before the AI & automation wave hit finance.

Ventana Research's Study

Ventana Research's 2022 survey is the most recent study into month-end close timelines. The study concluded that 59% of businesses take six business days to close out their books come month-end.

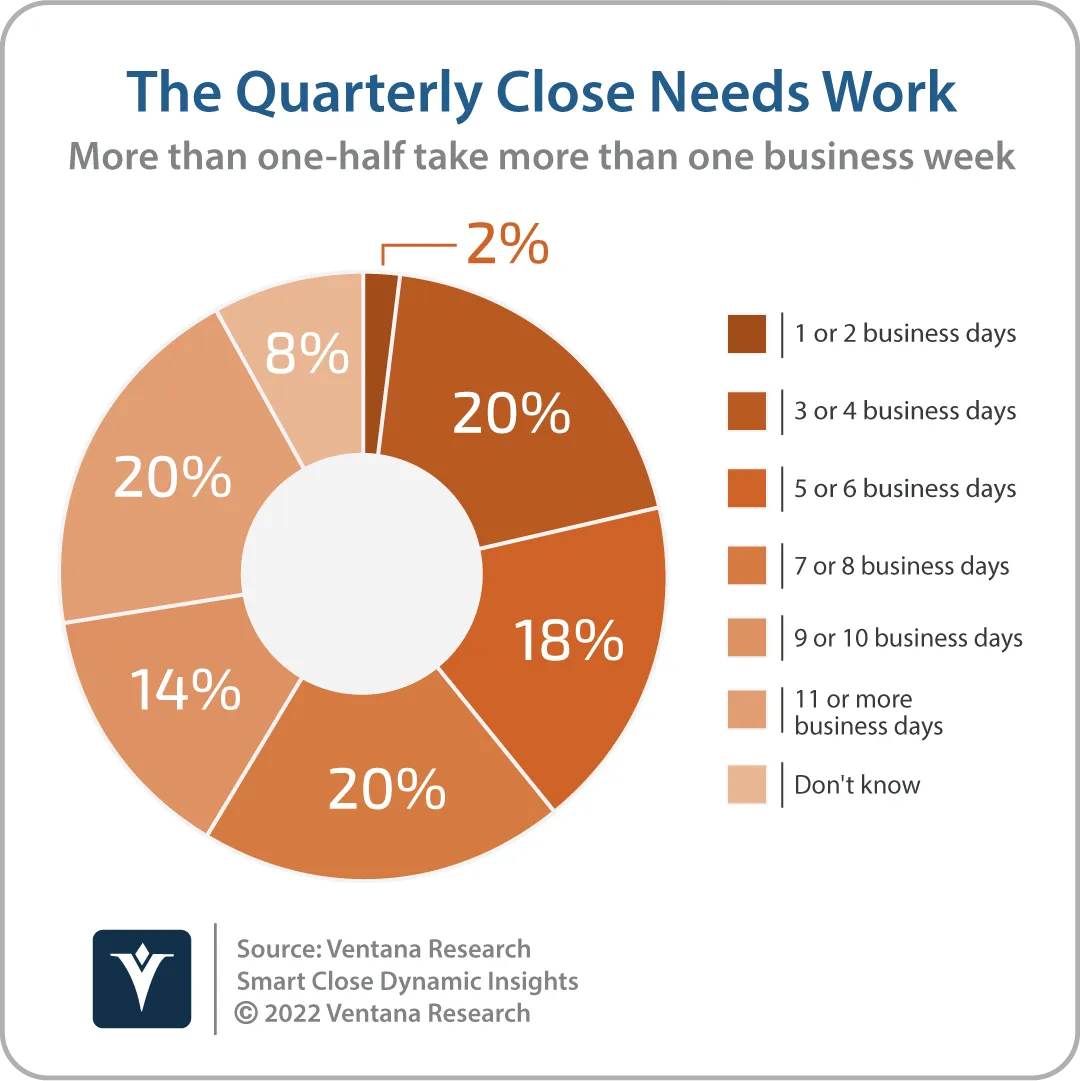

Quarterly closes take longer. A lower 43% reported closing their books in less than six business days at quarter-end.

Ventana Research’s survey into month-end close timelines

As we mentioned, this study has some nuances you must consider. Namely:

- The survey included just 48 companies— an invalid statistical sample.

- 70% of these companies had more than 1,000 employees and 500 million dollars in revenue.

- Less than 20% of companies were mid-sized or SMBs.

Despite the survey happening more recently, the small sample size and enterprise skew mean its findings are potentially less reliable.

Anecdotal Evidence from Accounting Communities

Discussions among accountants in online communities offer great insight into close timelines depending on company sizes.

Some observations from these threads and other anecdotal evidence:

- Most accountants at large companies indicate three days. Those without automation report a week to eight days.

- Smaller companies take 14 days.

- No matter the overall timeline, most accounting departments at mid-sized organizations say the bulk of their tasks finish in the first three days.

- Account reconciliations leading to financial reporting and financial documents (balance sheet, cash flow statement, income statement, etc.) are the most time-consuming task

- Private early-stage companies experience lengthy year-end closing periods due to pushing the bulk of their closing tasks to that period, choosing light closes throughout the year.

The bottom line: Assuming that you’re not held to public reporting standards, aim to finish your month-end close between five to seven calendar days. If you're a small team, aim for 14 days.

Is Your Month-End Close Taking Too Long?

You’ve read through the benchmarks. But again, everything is dependent on your business context— several variables that are out of your control and those within your control (like poor organization or month-end close processes) can extend close timelines.

Here are a few ways to narrow down why your closes may be taking longer than the benchmarked average:

- Variable #1 - How complex is your accounting?

- Variable #2 - How many people work on your team?

- Variable #3 - Are you a public or private company?

- Variable #4 - How does management use accounting data?

Variable #1- How Complex is Your Accounting?

Accounting complexity is one of the biggest causes of long close timelines. For instance, if you're a manufacturer and have to deal with inventory accounting, your close will likely take longer than a B2B SaaS company with a single product.

As complexity rises, accounting software can help you better organize and add visibility to your close process, automate bread-and-butter reconciliations by flagging discrepancies, and more easily drill deeper into transaction-level records without treasure-hunt style searches in your ERP.

Overall, take into account the complexity of your business when thinking through the benchmarking we listed previously. More complex? Adding a day or two may be normal. Less complex? Expect a faster close.

Variable #2- How Many People Work on Your Team?

Accounting team sizes are a limiting factor in most organizations. Closes can take extremely long if your accounting team is understaffed.

Small companies with one or two-person teams or outsourced bookkeeping firms should aim to close their books within two weeks. While longer timeframes aren’t unheard of, 15 business day closes are common.

Keeping to that timeline still may feel like a stretch, the smaller the team, the more important exploring automation and AI are to streamline workflows in your month-end process, accomplish more in real-time, and make the most of your limited hours in a week.

Close faster with Numeric

Variable #3 - Are You a Public or Private Company?

With additional reporting requirements and stringent accounting procedures, public companies are held to a clearer definition of what constitutes a month-end close, essentially a higher standard of completeness for verifying all financial activity.

For example, while a smaller, private company may hold off on accounting for stock comp with journal entries until quarter or year-end, public companies will handle this on a monthly basis.

Producing accurate financial statements as a public company requires sound accounting processes that can be fairly lengthy.

Given this, a 7 days or less close is the gold standard. This then allows for a quick hand-off of data to FP&A, providing ample time to hit reporting deadlines.

While most private companies don't experience such a burden, their growth stage might impose unique reporting requirements. For instance, a Series B company might need special KPIs to measure growth and analyze efficiency for board presentations.

Variable #4 - How Does Management Use Accounting Data?

Some company FP&A teams drill deep into financial data, forecasting to map growth paths and estimate headcount needs.

The more the underlying accounting data is used by stakeholders, the more accounting teams feel the pressure to compress their close.

A 15-day close may work for finance teams simply staying on top of tax filing, payroll, and accounting basics during an accounting period, but for teams handing over data to a CFO for reporting and decision-making, a shorter close is needed for the rest of the business to stay on track.

When judging if your financial close is taking too long, consider the downstream effects of what each additional day enables the company to analyze and act on. In some cases, faster accounting data can translate to faster and better business decisions.

How Can You Speed up Your Month-end Close?

The first step to speeding up your month-end close is outlining all tasks involved and what dependencies exist that are bottlenecks for your team in a month-end close checklist. We’ve compiled some templates to help your team get started.

Once you’ve outlined the full process, take a pen to what manual processes can be automated via software and where tasks can be allocated to team members with more bandwidth.

Decreasing your time to close is iterative, focus on isolating a few ways to make the close next month faster than the previous month. For ideas on closing faster, read through our e-book on mastering the month-end close with tips from top accounting teams.

Get started with Numeric for free to organize & add visibility to your month-end close.

.png)

.png)

.png)