6 Best Alternatives to FloQast

.webp)

The month-end close forms the foundation of your company’s financial data. Naturally then, selecting the best close management software is a key decision for Controllers and accounting managers.

While FloQast can be a great fit — covering the basics of your monthly close checklist and reconciliations — for teams looking for more power, cheaper alternatives, or who are just curious about what else is on the market, we’ve compiled a shortlist of alternatives to explore.

In this article, we help you navigate the maze of software choices, listing the top FloQast competitors and explaining when it makes sense to consider each choice.

To rank the top FloQast alternatives, we considered accounting tools and capabilities, integrations with ERPs and other platforms, ease of implementation and use, customer reviews, and common pros and cons.

The six best FloQast competitors are:

- Numeric: Best Overall FloQast Competitor

- BlackLine: Best FloQast Competitor for Mature Companies with Dedicated Admins

- Cube: Best FloQast Competitor for Teams That Prioritize Working in Excel

- Adra by Trintech: Best FloQast Competitor for Native Workday Integration

- OneStream: Best FloQast Competitor for Integration with FP&A Budgeting Tools

- Workiva: Best FloQast Competitor for Companies Looking to Consolidate Their Work in Workiva

How We Selected the Top FloQast Competitors

You’ll spend quite a bit of time in your month-end close tool. So it’s important that it’s easy to use, modern, and powerful enough to streamline closing.

When choosing the best FloQast competitors, we focused on the following aspects and factors:

- Platform coverage and comprehensiveness: We searched for cloud-based software that goes beyond basic financial close management and offers advanced tools that allow for a continuous close process. We selected alternatives to FloQast that check off the key buckets of work involved in the financial close, including account reconciliation, flux analysis, project management, quick reporting, and transaction monitoring throughout the month.

- Integrations and compatibility: We focused on products that integrate seamlessly with multiple ERPs and other third-party accounting platforms without needing knowledge of APIs.

- Cutting-edge technology: We gave priority to software products that use the latest technology coupled with modern interface and UX.

- User-friendliness: We weighted more heavily platforms that are easy to use and do not require specialized knowledge or extended training for small businesses and enterprises alike.

- Onboarding process and customer support: We considered close management software that provides straightforward implementation. We ensured that ranked competitors of FloQast provide efficient ongoing support, from implementation, throughout the customer journey.

- Pricing: We looked at the pricing model of each FloQast alternative, including setup costs, recurring subscription fees, and additional costs like training and access to advanced features.

- Customer reviews: We combed through each product’s reviews on G2 as one of the most trustworthy review websites for software tools.

1. Numeric: Best Overall FloQast Competitor

Numeric ranks as the top FloQast alternative. An up-and-comer in the close management space with plenty of momentum, Numeric has focused on bringing tech advances (like AI, best-in-class design, and deep database integrations) to the world of accounting.

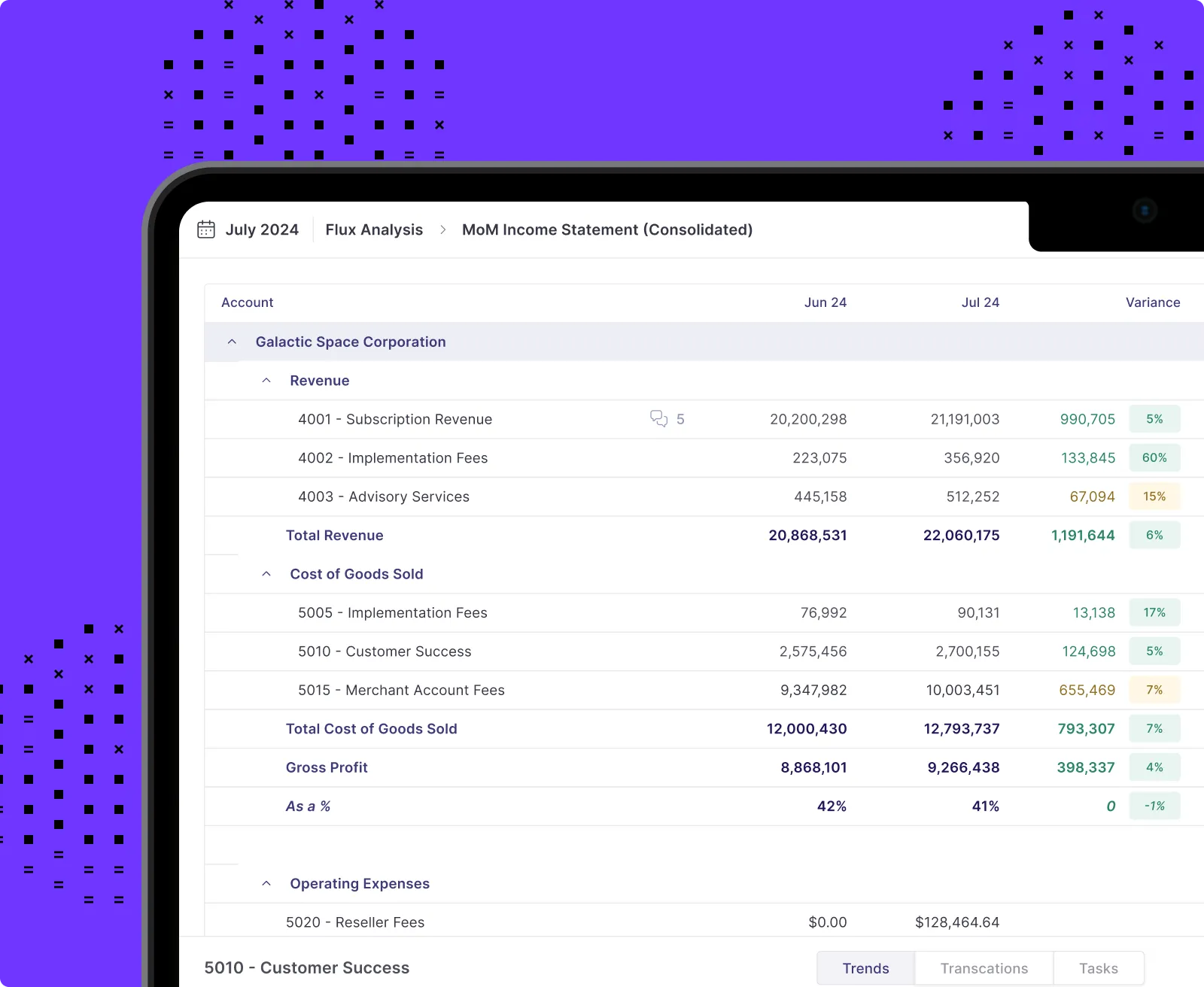

While other close management tools provide primarily a month-end checklist to manage tasks, Numeric has created a workspace for the close — teams actively generate accounting policies and get technical accounting guidance using AI, automate reconciliations, generate flux explanations, report flexibly, and have full team-wide visibility into the status of their close.

Powerful, without being complicated, Numeric’s transaction-level syncs save users time spotting changes since an account was last reconciled, and task dependencies outline the full order of operations of the close.

Rated the close management software with the highest user adoption, the easiest admin, and the choice teams were most likely to recommend out of mid-market options — Numeric is quickly grabbing attention by tech-forward accounting teams.

Numeric Features

- Advanced task management, including task dependencies

- AI-assisted accounting functionality including a policy bot for GAAP fundamentals and AI-driven flux analysis explanations

- Alerts notifying of changes after an account was last reconciled, identifying the specific transaction that resulted in the alert

- Transaction-level drill downs across the platform, so that accountants and Controllers no longer need to look for a needle in a haystack

- Summaries of daily tasks

- View-only permissions for the FP&A team

- Tracking of monthly progress

- Flexible search and reporting functions for GL data, building on Oracle NetSuite’s saved searches

Numeric Costs

Numeric is the up and comer in the financial close management space quickly gaining traction with leading accounting teams. By leveraging transaction-line ERP syncs and AI to streamline month-end close, Numeric helps accounting teams automate account reconciliations, auto-draft flux analysis, and monitor transactions for a more proactive close.

Numeric offers a Starter plan that's focused on close management and then Growth and Enterprise paid plans that incorporate account reconciliation, flux analysis, search, and reporting capabilities.

- Starter: This plan is ideal for teams that want to organize the close process and improve control and visibility.

- Growth: This plan helps streamline and consolidate the financial close through integrations and automations, like reconciliation and flux analysis.

- Enterprise: This plan provides access to advanced features (like transaction monitors) that help implement a proactive monthly close.

Numeric Setup Process

The extremely intuitive and straightforward implementation is one of the benefits that make Numeric the top FloQast alternative. The setup process requires the following steps:

- Sign up for the appropriate plan

- Import your existing financial close checklist

- The Numeric team integrates your GL and helps adjust settings for account reconciliations and flux analysis

- Get started

Teams are able to close with Numeric in the first month in which they sign up for the product.

Numeric Reviews

Most customers have evaluated Numeric with 5 stars.

- G2: 4.8/5 stars

Happy customers praise the ability to shorten the monthly close process by at least a day, the real-time visibility, and the ahead-of-the-curve use of AI. Users also call out the advanced automations, easy progress tracking, and the deeper ERP system integrations.

In reviews, Numeric users also highlight the intuitive interface and dashboard with straightforward team collaboration across accounting and finance teams. All in all, the platform helps boost efficiency considerably.

Numeric Pros and Cons

Numeric Pros

- Ahead-of-the-curve implementation of AI and automation

- Deep ERP integrations with transaction level details

- Extremely easy and intuitive to implement and use

Numeric Cons

- Lack of integrations with all ERPs

- A new accounting platform to acclimate

How to Get Started with Numeric

To get started with Numeric, prospective customers can schedule a demo with the team to learn more about reconciliations and flux analysis.

2. BlackLine: Best FloQast Competitor for Mature Companies with Dedicated Admins

As one of the most popular FloQast alternatives, BlackLine tends to be a good option for large businesses and organizations that need powerful automations within their accounting processes but that also have the necessary human and financial resources to support the setup and proper use.

As the most mature player in the space, BlackLine works with large, public companies and has been in business the longest. Typically, teams that adopt BlackLine require a full-time administrator to implement and maintain the platform.

BlackLine Features

BlackLine gives access to the following tools and features necessary for financial close management:

- Account reconciliations (ex. For accounts payable)

- Financial task management

- Transaction matching

- Journal entry

- Compliance through the execution of control workflows

- Variance analysis to identify and monitor risk

- Smart close in SAP

- Consolidation integrity manager

- Transaction-level analysis of high-volume, high-risk accounts

- Financial reporting analytics

BlackLine Costs

BlackLine offers different plans, depending on access to features and size of the team. All in all, comparison between FloQast vs BlackLine shows that the latter ends up being more expensive than the former as well as the majority of alternative solutions. Frequently, there are one-time and recurring costs including but not limited to implementation fees, configuration fees, integration fees, data migration fees, the annual subscription, and administrative services costs. BlackLine does not provide a free trial.

BlackLine Setup Process

BlackLine has one of the more time-consuming onboarding processes among all FloQast competitors. On average, teams need 4.5 months to get started with BlackLine.

The setup up process requires:

- Set up task management for monthly financial close

- Integration with your ERP

- Connect BlackLine with supporting workpapers

- Configure workflows using readily available or custom templates

However, much of the time required for on-boarding is a direct reflection of the advanced customization options. The BlackLine customer success team provides support throughout the process, but may charge separate setup, integration, or data migration fees.

BlackLine Reviews

Most BlackLine rankings are 4 and 5 stars.

- G2: 4.5/5 stars

Satisfied BlackLine customers mention the tracking capacities, the matching system, the elimination of manual tasks, the reporting centralization, and the availability of the customer support team.

Meanwhile, some customers report difficulties in implementation and usage and the need for a dedicated administrator.

BlackLine Pros and Cons

BlackLine Pros

- Powerful automations, particularly BlackLine account reconciliation

- Integrations with the most popular as well as less popular ERPs

- Comprehensive functionalities

- Good fit for large enterprises and organizations

BlackLine Cons

- Fairly involved implementation, use, and maintenance

- Need for dedicated admins

- Costly pricing model with multiple one-time and ongoing fees

How to Get Started with BlackLine

To get started with BlackLine, customers need to schedule a demo via the company website.

3. Cube: Best FloQast Competitor for Teams That Prioritize Working in Excel

Cube is a good alternative to FloQast for teams that enjoy working in Excel spreadsheets or Google Sheets and would like a lightweight way to continue working in spreadsheets even after implementing financial management accounting SaaS. The platform is also a top choice for companies in which the accounting team owns forecasting.

Cube Features

Cube offers access to:

- Full compatibility with Microsoft Excel and Google Sheets, allowing teams to stay within spreadsheets

- Centralized data management with filtering and visualization options

- Flexibility to add new models, scenarios, and workflows for forecasting

- Financial planning and modeling

- Straightforward reporting and analytics

Cube Costs

Unlike other FloQast alternatives, Cube breaks down available plans on the company website. The company offers three subscription plans to meet the requirements of teams with different sizes and varying needs.

- Cube Go: This plan is best for lean teams and helps improve speed, accuracy, and accountability. Pricing starts at $1,500/month.

- Cube Pro: This package is best for companies looking to scale reporting, planning, and performance. Pricing starts at $2,800/month.

- Enterprise: This level is best for pre-IPOs and public companies that need best-in-class performance. Pricing is custom.

Cube does not offer a free trial and there is no free plan.

Cube Setup Process

The process of getting started with Cube is relatively easy, at least as outlined on the Cube website, including the following steps:

- Request a personal demo where you can select the right plan for your team

- Download the spreadsheet add-on

- Invite your team members

- Start mapping available data

Cube Reviews

Most customers have given Cube 4 or 5 stars in their online reviews.

- G2: 4.5/5 stars

On the positive side, customers enjoy the platform as an extension of tools they are already familiar with (spreadsheets) making it relatively user-friendly, the budgeting and forecasting functionalities, the degree of flexibility in data aggregation, and the helpful customer support.

On the negative side, customers mention the implementation, the absence of some features such as headcount planning or robust forecasting, the slow updating and processing of multiple reports, and the considerable learning curve.

Cube Pros and Cons

Cube Pros

- Continue working in Excel spreadsheets or Google sheets for teams that are comfortable with this structure

- Management of some FP&A workflows besides financial close management

Cube Cons

- Functionality is limited when working in spreadsheets (ex. challenging to build advanced workflows such as automated email campaigns, task dependencies, email digests, native integrations)

- Not a good option for accountants and controllers who are searching for close management software that takes work out of spreadsheets

How to Get Started with Cube

To get started with Cute, customers need to book a demo on the company website.

4. Adra by Trintech: Best FloQast Competitor for Native Workday Integration

Adra by Trintech provides an alternative to FloQast for teams that consider integration with Workday to be an integral part of the decision-making process.

Adra by Trintech Features

The main features provided by Adra by Trintech are:

- Compatibility with Workday

- Account reconciliations

- Transaction matching

- Close task management

- Journal entries

- Intercompany accounting

- Audit and compliance

- Reporting and analytics

- Financial consolidation and close

Adra by Trintech Costs

The company website does not provide information on the pricing model for the product, and there are no estimates on third-party websites. Interested customers need to get in touch with Adra by Trintech and ask for a quote.

Adra by Trintech Setup Process

Adra by Trintech does not explain the implementation process step by step. Nevertheless, the customer success team delivers a detailed introduction to the product during the setup stage.

Adra by Trintech Reviews

The majority of customer reviews of Adra by Trintech comprise 4 and 5 stars.

- G2: 4.4/5 stars

Positive reviews discuss the detailed introduction at launch, the ability to continue adding data at all times, the accurate reconciliations, the good task management tool, the automation, and the great customer support staff.

Some negative aspects mentioned in customer reviews include limited customization options, sometimes difficult to find and use menus, and sluggishness when updating or when used by multiple team members simultaneously.

Adra by Trintech Pros and Cons

Adra by Trintech Pros

- Ready integrations with major ERPs and GLs

- Existing partnerships with multiple top accounting firms

- Good option for large businesses

Adra by Trintech Cons

- More difficult to navigate UX and design than other FloQast competitors

- Not a good fit for small-size and mid-size enterprises which usually find Adra to be more developed than needed

How to Get Started with Adra by Trintech

To get started with Adra by Trintech, customers need to request a demo via the company website.

5.OneStream: Best FloQast Competitor for Integration with FP&A Budgeting Tools

Unlike other FloQast competitors, OneStream provides advanced integration with FP&A tools for planning, budgeting, and forecasting. This makes OneStream a good fit for companies looking to incorporate financial planning and analysis within the same platform.

OneStream Features

As an alternative to FloQast, OneStream offers the following features:

- Financial close and consolidation

- Financial signaling

- Account reconciliations

- Transaction matching

- Compliance software solutions

- ESG reporting and planning

- Tax provision

- People, capital, and sales planning

- Budgeting and forecasting

- Profitability analysis

- Reporting and analytics

OneStream Costs

OneSteam does not provide information on the cost of the platform on the company website. Based on online customer reviews, OneStream is more costly than other FloQast competitors.

OneStream Setup Process

On their website, OneStream does not explain the onboarding process and how involved the customer success team is. The company offers multiple options for advanced training that are likely to be paid.

OneStream Reviews

Most customers have given OneStream 4 or 5 stars on the G2 review platform.

- G2: 4.7/5 stars

Customers mostly benefit from the access to data, the automated operations, the integration with Microsoft applications, the flexible reporting capabilities, and the customization options.

At the same time, according to customers, metadata management can be inefficient, monthly close performance is rather slow, and implementation and customization can be complex.

OneStream Pros and Cons

OneStream Pros

- Availability of additional products, specifically for FP&A teams

- Advanced reporting and analytics features

OneStream Cons

- More expensive than other FloQast alternatives

- Limited integrations with top ERPs. For instance, no integration with QuickBooks, Sage Intacct, and Xero.

How to Get Started with OneStream

To get started with OneStream software, customers need to sign up for a demo via the company website.

6. Workiva: Best FloQast Competitor for Companies Looking to Consolidate Their Work in Workiva

Finally, Workiva is a FloQast alternative that brings together a variety of finance and accounting tools under its umbrella, primarily used by public companies. This could be a good fit for businesses that are already reporting within Workiva and are now looking for a close management accounting software that integrates within the same platform.

Workiva Features

The most important capabilities available with Workiva include:

- Multi-source data centralization and simplification (ex. CRM integrations)

- Month-end close task management

- Financial statement automation

- Risk management tools

- Product line and business unit reporting

- Management reporting

- ESG reporting

- Annual and interim reporting

Workiva Costs

The Workiva website does not discuss the subscription plan options and the pricing structure. There is no related information on third-party sources either.

Workiva Setup Process

While the Workiva website does not outline the steps of the implementation process, the setup process is driven by the specific subset of Workiva’s cloud-based platform features and the team size.

Workiva Reviews

The majority of online customer reviews comprise 4 or 5 stars.

- G2: 4.5/5 stars

Some customers like the dynamic and adaptable product, the professional design, the efficient document management, and the real-time collaboration.

Meanwhile, customers voiced concerns with the difficult implementation, the lack of appropriate drag-and-drop features, and the inefficient process to roll forward.

Workiva Pros and Cons

Workiva Pros

- Full integration with other Workiva tools and products

- Sophisticated support system available to enterprise-level customers

Workiva Cons

- Complex implementation

- Automation limitations

How to Get Started with Workiva

To get started with Workiva, customers need to schedule a demo through the company website.

Conclusion: Choosing the Best FloQast Alternative for Your Business

Ultimately, choosing the right close management tool is dependent on your specific team needs. Is it important to integrate with FP&A tools? What ERP does your company currently use? How does easy of use stack rank against other priorities?

The best way to sift through the choices after reading this breakdown is to select a few to demo, ask your specific set of questions, and better understand the impact each tool will have on your team’s work.

If you’re looking to evaluate options immediately, get started on Numeric’s close management tool here.

.png)

.png)

.png)