A Comprehensive Approach to Account Reconciliation

Death, taxes, and reconciliations.

Only two of those are certain for everyone, but for accountants, reconciliations are just as good of a guarantee. If businesses want to know where, when & how their money is moving, they need to feel confident in the accuracy of their financial data.

This process, known as account reconciliation, not only ensures that all reporting on the business is accurate, but also helps to establish audit-readiness. It’s essential that accounting teams nail down their account reconciliation practices as soon as possible.

What is Account Reconciliation?

Account reconciliation involves comparing two sets of financial records to ensure that the underlying details are correct. In practice, this looks like comparing an account’s trial balance to supporting documentation: bank statements, workpapers, aging reports, invoices, etc.

The main goal of account reconciliation is to make sure that the general ledger accounts are consistent, accurate, and complete. By performing account reconciliations, a team can identify any discrepancies within the account's subledger or the general ledger that need to be corrected.

Why is Account Reconciliation Important?

Financial statements—like balance sheets and income statements—rely on accurate data; so account reconciliation is crucial for the integrity of these statements and the month-end close process.

This is particularly important for public companies that must comply with regulations such as Sarbanes-Oxley: account reconciliation serves as one of these controls, providing a documented trail that auditors can review. This helps ensure compliance and avoid penalties.

Without reconciliation, errors and omissions could go unnoticed, leading to incorrect financial reports. Beyond that, regular reconciliations also serve to detect and prevent fraudulent activities. By consistently comparing internal records with external documents, businesses can identify unusual transactions that may indicate fraud – for example, reconciliations can uncover unauthorized payments or discrepancies indicative of embezzlement.

Last but certainly not least, understanding your company’s financial health is dependent upon account reconciliation. Keeping a close eye on your financial transactions ensures that you always know your cash position and can monitor cash flow adeptly. Likewise, reconciling your bank accounts can help you avoid overdrafts by ensuring that all ongoing payments are accounted for. This not only saves on overdraft fees but also helps maintain a healthy cash flow, which is vital for day-to-day operations.

Overall, account reconciliation is an indispensable tool for maintaining the accuracy, security, and compliance of financial records.

Types of Account Reconciliation

Account reconciliation can take several forms, depending on the type of account being reviewed. Some common reconciliations for GL accounts include:

- Balance Sheet Reconciliation: Checks the balances in various asset, liability, and equity accounts on the balance sheet with general ledger.

- Accounts Payable Reconciliation: Typically matches trial balance from your AP ledger and your AP aging report.

- Accounts Receivable Reconciliation: Matches AR ledger balance with unpaid sales invoices.

- Fixed Asset Reconciliation: Compares GL trial balance with fixed asset subledger totals.

- Bank Reconciliation: Compares a company’s bank statement with internal cash records.

While most balance sheet reconciliations follow the format where an existing general ledger balance is compared against a corresponding workpaper, certain reconciliations like bank & cash recs use other documents for verification.

How Often Should I Reconcile Accounts?

Establishing a regular schedule for account reconciliation is essential to maintaining accurate financial records. The frequency – whether daily, weekly, or monthly – depends on transaction volume and complexity. For instance, businesses with high transaction volumes or account activity might benefit from daily reconciliations to prevent discrepancies from accumulating.

For balance sheet accounts, reconciliations should be done at month-end as a part of the month-end close process. Manyt companies will reconcile about 70% of these accounts monthly, but when faced with their first audit, complete full balance sheet recs.

Two Methods of Account Reconciliation

Account reconciliation can be performed using different methods to ensure accuracy. Here are two basic approaches:

Document Review Method

This method involves comparing transactions in your financial records with supporting documents. For example, you might match receipts, invoices, or bank & credit card statements with entries in your ledger.

- Primary Use: Best for detailed verification.

- Example: Comparing a vendor invoice with your accounts payable ledger to ensure the amounts match.

Variances Review Method

This approach involves historical analysis and comparing it to current data. If there are significant differences between projected and actual figures, it might indicate an issue.

- Primary Use: Useful for high-level checks.

- Example: Analyzing trends in monthly expenses and comparing them to current month expenditures to spot anomalies.

Account Reconciliation Process at Month-End

Before You Start (or Step 0)

Ahead of diving into your reconciliation, first double check that prior periods were properly reconciled. You’ll want to confirm that the beginning balance of the current month’s report matches with the ending balance of the prior month’s report.

If using Numeric, you’ll be automatically notified when an account that was previously reconciled no longer ties out automatically with prior period balance monitoring.

If they match, green flag to continue.

Otherwise, you’ll need to reconcile prior periods before jumping into the current month.

1. Compile necessary documents and data sources

Before starting, collect all supporting schedules related to the given account – that could be bank statements, card statements, invoices, fixed asset registers, and more all depending on the account.

For instance, with an account like prepaid expenses, you’ll want to pull up your prepaid expense workpapers. Make sure all documents are up to date. This step sets the foundation for a smooth reconciliation process.

2. Cross-reference the trial balance & totals in account workpapers

Most reconciliations involve checking some supporting schedule against the general ledger. Pull your trial balance for the account and compare against totals in workpapers. If the totals tie out, then you can assume that all the underlying entries also align. If they don’t, you’ll have to look to see where discrepancies lie.

If using Numeric for account reconciliation, your GL balance and workpaper total will automatically be pulled in, no need to download trial balances. Then you can drill directly into transactions to pinpoint any discrepancies.

3. Addressing discrepancies: adjustments and updates

Should discrepancies arise, be sure to investigate the cause and then account for them: for an account like fixed assets for example this might include updating the recorded value of an asset, ensuring accumulated depreciation is correct, adding missing assets to the books, or writing off assets that are no longer there.

4. Perform final review

Lastly, see that all prior steps have been thoroughly completed.

Example of Bank Account Reconciliation in Corporate Accounting:

Gerry works as an accountant for Tall-Task Tools, a manufacturing company. One of his monthly tasks is to reconcile the company's bank account with the bank statement to ensure accuracy and completeness of financial records.

- Gather Bank Statement and Cash Book: At the end of each month, Gerry receives the bank statement from the company's primary bank. This statement lists all transactions (deposits, withdrawals, bank fees, interest earned, etc.) that occurred during the month. He also has access to the company's general ledger, which records all cash transactions affecting the bank account.

- Compare Transactions: Gerry ensures that the balances on the bank statement match what has been recorded in the company’s GL. If there are discrepancies, he can compare individual transactions to see where there is misalignment.

- Identify Discrepancies: During the reconciliation process, he may identify discrepancies such as:

- Bank fees or interest charges not recorded in the company's records.

- Deposits or withdrawals recorded in the cash book but not yet processed by the bank.

- Errors in transaction amounts or dates.

- Adjust for Timing Differences: Timing differences can occur due to the processing times between the company and the bank. For example, deposits made at the end of the month may appear in the cash book but not on the bank statement yet. Similarly, checks issued by the company may not have been cashed by recipients and thus do not appear as withdrawals on the bank statement.

- Resolve Discrepancies: To resolve discrepancies, Gerry investigates each item thoroughly. He may have to contact the bank for clarification on specific transactions or review internal records to ensure all transactions are properly recorded.

- Make Adjustments: Once discrepancies are identified and resolved, adjustments are made to the GL to reflect the correct balances.

- Finalize Reconciliation: After making adjustments, Gerry ensures that the ending balance of the bank account in the company's records matches the ending balance on the bank statement. This confirms that all transactions for the period have been accounted for accurately.

- Document Reconciliation: It's important to document the entire reconciliation process, including any adjustments made and explanations for discrepancies. This documentation serves as evidence of the company's financial controls and is essential for audits and financial reporting.

Bank account reconciliation is crucial for detecting errors, unauthorized transactions, or discrepancies in cash balances, thereby ensuring the accuracy of financial reporting and maintaining the integrity of the company's financial records.

Best Practices for Account Reconciliation

Prioritize key accounts via scheduling

Not every account in your chart of accounts is going to need frequent vetting – if your business has few fixed asset transactions, then you’d probably be fine leaving fixed asset reconciliation to just month-end or automating preparation of the recon all together with Numeric. Cash accounts, on the other hand, almost necessitate a daily reconciliation.

High-priority accounts usually either have the highest volume of transactions, take the most time to reconcile at month-end, or have the greatest impact on the company’s bottom line.

Build in daily or weekly reviews for these accounts before any others. For remaining accounts, use your best judgment to decide reconciliation frequency: as a general rule of thumb, the higher the volume or complexity of the account’s transactions, the more frequently you should review the account.

Segregation of Duties

Account reconciliation works well when teams separate the responsibilities of recording and reconciling items. This is a crucial internal control measure to prevent fraud and errors.

In smaller organizations where staffing may be limited, consider implementing regular supervisory reviews or using automated reconciliation tools to add another layer of oversight.

Customers on Numeric can clearly assign preparers and reviewers for tasks with full audit-ready documentation built-in.

Detailed Sets of Records

It’s imperative to maintain detailed records of the current reconciliation process and any adjustments made. Proper documentation is vital for transparency and accountability. Each step of the reconciliation process should be clearly recorded, including any discrepancies found and the actions taken to resolve them. This practice not only aids in internal reviews but also provides an audit trail.

Incorporating Account Reconciliation Software

If your team is treading water or even underwater with a manual close, it might be time to consider implementing accounting software.

Automation offers a solution to many of the key challenges in account reconciliation: it minimizes errors, handles large volumes of data efficiently, and reduces time spent on the most repetitive of tasks.

By automatically pulling a company’s trial balance and totals from supporting sources, teams automate much of the reconciliation process and auto-submit recons that are below the materiality threshold.

Communicate regularly with customers & team stakeholders

Maintain ongoing communication with customers regarding their account balances. This includes sending out account statements, reminders for upcoming or overdue payments, and addressing any questions or disputes that may arise.

Similarly, ensure that teams within your organization are submitting necessary documentation for their transactions and have a clear and direct communication process for accounting questions.

By following these steps, you ensure that your financial records are accurate and reliable, providing a clear picture of your company's financial health.

Common Challenges in Account Reconciliation

Impact of Large Volumes of Transactions

Handling a large number of transactions can overwhelm even the most organized accounting teams – this is especially true for industries like retail or finance where transactions are both frequent and numerous. The sheer volume can lead to delays in the reconciliation process, which in turn bogs down the month-end close as well.

Complexity

Businesses that operate across various locales or have multiple subsidiaries face additional challenges in account reconciliation.

For instance, a multinational corporation needs to reconcile intercompany transactions between its headquarters and international branches, taking into account different tax laws and financial regulations. This complexity requires a robust reconciliation system capable of integrating diverse accounts and providing a consolidated view of the company's financial health.

Data Accuracy

Human errors in data entry are common and can lead to significant discrepancies.The same can be said for missing transactions where a transaction is recorded in one system but doesn’t appear in another.

Ensuring that all data aligns correctly requires meticulous attention to detail and often, sophisticated data transformation tools. Inaccurate data can lead to incorrect reconciliations, impacting the overall financial integrity of the business.

Manual Processing

Manually matching external statements with internal records can take hours or even days, especially if discrepancies require further investigation. Tasks such as data entry, matching transactions, and correcting errors are time-consuming and repetitive. Businesses can mitigate this by adopting automated reconciliation software that streamlines manual workflows and minimizes errors.

Frequently Asked Questions (FAQ)

How hard is account reconciliation?

The difficulty of account reconciliation can vary based on several factors.

- Complexity of Transactions: More complex transactions require detailed analysis and can be harder to reconcile.

- Volume of Transactions: High volumes increase workload and the risk of errors.

- Manual vs. Automated Processes: Manual reconciliation is more challenging and error-prone. Automation simplifies the process.

Account reconciliation can be challenging, but automation with tools like Numeric and structured processes make it manageable and efficient.

How Numeric Helps Accounting Teams with Account Reconciliation

- Manage balance sheet reconciliations in a single place: For month-end account recs, teams can pull the account balance total automatically from workpapers and the trial balance from their GLs. Even better, with a deep ERP integration, Numeric users can click into underlying transactions across accounts to investigate. Prior period balance monitoring catches any changes since accounts were reconciled.

- Remain organized and audit-ready with clear controls and documentation: Assign reviewers and preparers of reconciliation tasks and capture all comments, changes, and task submissions in a clear month-end close checklist. Auditors then directly log-into Numeric with a clear activity trail, no need for your team to spend hours resurfacing required documentation.

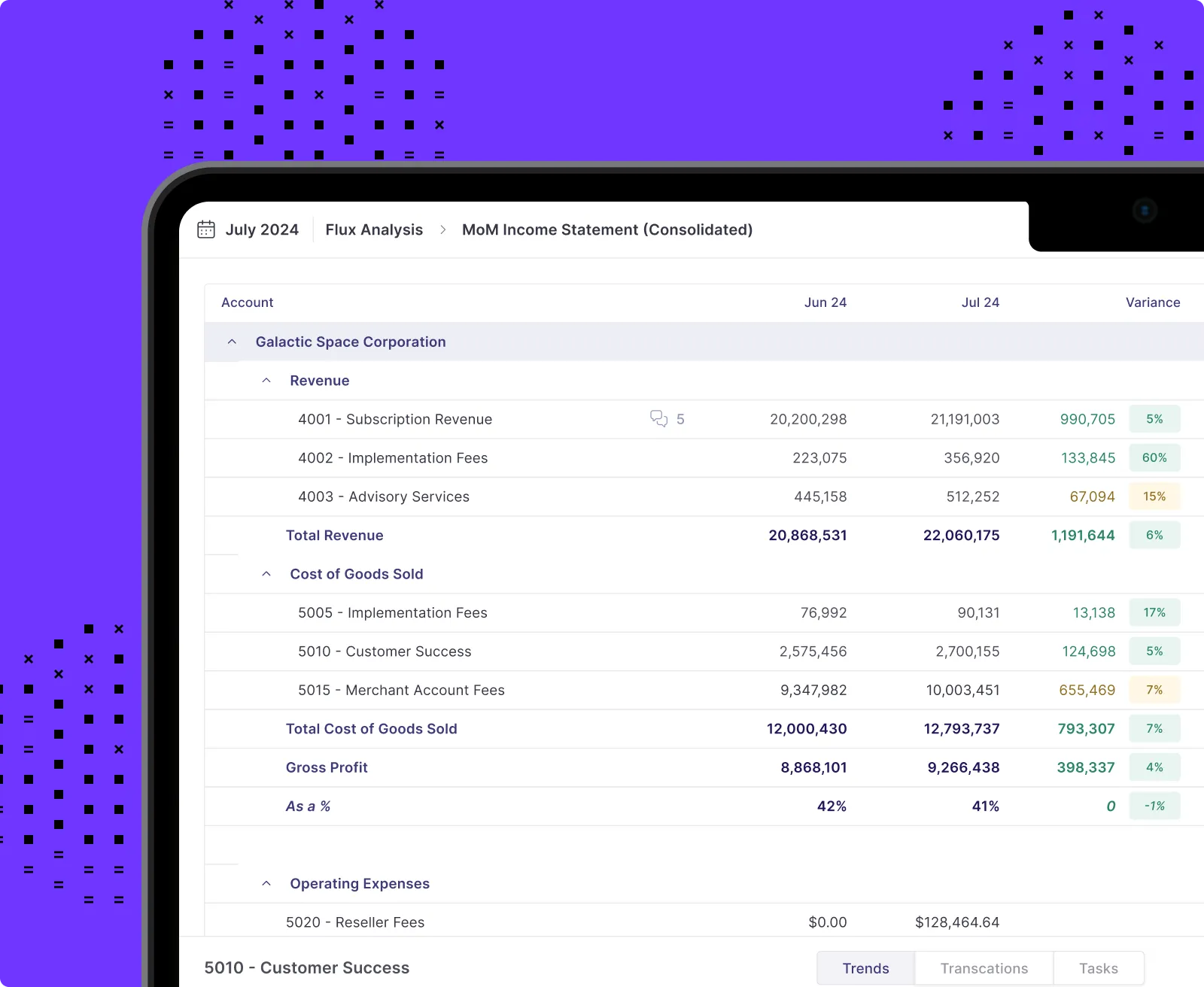

- Catch anomalies with flux analysis: Easily compare accounts MoM or QoQ to spot anomalies or layer in insights with auto-generated flux reporting. With Numeric, AI takes the first pass at writing variance explanations by combing through all transaction-details in an account and identifying key drivers of change.

- Report easily on asset transactions and enable FP&A: Pivoting transactions by customer? Grouping by class? Numeric integrates every transaction line from your ERP in real-time to enable quick reporting as a part of the month-end close process. With view-only access roles included in all accounts, FP&A teams can check actuals directly in Numeric to monitor how much was spent and monitor cash flow without needing to contact the accounting team prematurely.

- Set-up ongoing transaction monitoring: With Monitors, you can flexibly set-up ongoing alerts to catch errors ahead of month-end account reconciliations. Catch any transactions tied to particular customers or, for Controllers doing a quality check of the full month-end process, surface all journal entries booked to A/R to scan through.

The Bottom Line on Account Reconciliation

Ultimately, a robust account reconciliation process not only safeguards financial health but also strengthens the foundation for sustained business growth and success.

Therefore, accounting teams must excel at their reconciliation practices early on, laying a solid foundation for financial transparency, operational efficiency, and long-term business success.

.png)

.png)

.png)