Ultimate Guide to Accounts Receivable Reconciliation

.webp)

Accounts receivable reconciliation may not be the most exciting task in the accounting world, but it's crucial for maintaining a business's financial integrity.

By implementing an effective accounts receivable reconciliation process, accountants can not only prevent financial discrepancies but also significantly contribute to their company’s strategic financial planning.

What Is Accounts Receivable Reconciliation?

Accounts receivable reconciliation can refer to either ongoing A/R reconciliation activities or the month-end A/R reconciliation process.

During month-end, the accounts receivable reconciliation process involves reconciling the accounts receivable general ledger balance with the total of unpaid customer billings from a sales ledger, often the A/R aging report.

Ongoing recs involve applying payment received to invoices and scanning for discrepancies.

The accounts receivable reconciliation process is similar to other reconciliation processes, such as bank and A/P reconciliations. However, given that AR involves more input from your team to issue invoices as well as collecting and receiving payments, there are more avenues for errors to slip through the cracks.

Potential accounts receivable errors can arise from duplicate entries, missed payments, or incorrect postings. Accounts receivable reconciliation helps find and correct these potential errors, ensuring the company’s financial records are as accurate as possible.

Why Is Accounts Receivable Reconciliation Important?

Accounts receivable is a critical account that ultimately appears in your financial statements. Errors in the balance of this account can directly lead to inaccuracies in your reported financial health. This misreporting can have severe implications.

Inaccurate financial reports can mislead stakeholders about the company's performance and stability. It could also affect decision-making and investor confidence. Furthermore, if any required statutory financial reporting is incorrect, it could result in regulatory consequences.

For instance, inaccuracies in your financial statements could lead to errors in the income and expenses reported to the IRS, potentially resulting in audits, penalties, or fines. This could not only strain financial resources but also damage the company's reputation.

Regular accounts receivable reconciliation is essential to maintaining the integrity of your accounting records and financial statements, safeguarding against financial misrepresentation and its repercussions.

Accounts Receivable Reconciliation Process - Ongoing

Maintaining an accurate and up-to-date accounts receivable ledger requires regular attention. Implementing an ongoing reconciliation process daily or weekly is essential to effectively managing your cash flow and minimizing errors.

Overall, your focus on an ongoing basis is to ensure that you’ve captured all invoices that you’ve sent and applied any payments that have been received.

Here are the key steps for ongoing accounts receivable reconciliation:

Review transactions daily or weekly

Regularly review incoming payments and apply them against outstanding invoices to maintain the health of your order to cash process. This daily or weekly task helps identify any immediate payment discrepancies, such as partial payments or overpayments. It also ensures all transactions are recorded accurately in real-time.

When reviewing, pay attention to potential overpayments or underpayments and recurring bill pay without a corresponding invoice.

While this is often done by manual matching, some accounting teams will instead use software like Chargbee to automatically match invoices and payments or will handle issuing invoices and collecting payments in the same system like companies that use Stripe.

Update customer accounts and your general ledger promptly

As payments are received, update your customers' accounts receivable records. Promptly recording transactions prevents discrepancies and errors from accumulating and provides a real-time view of each customer's account status.

Depending on where your AR process takes place, this may involve booking an appropriate debit and credit entry in your general ledger or posting a summary entry encompassing several transactions.

This is a crucial step to effective credit management and maintaining healthy customer relationships.

Communicate regularly with customers

Maintain ongoing communication with customers regarding their account balances. This includes sending out account statements, reminders for upcoming or overdue payments, and addressing any questions or disputes that may arise.

Regular interaction with your customers can help you resolve issues promptly, something that’s vital for efficient accounts receivable management.

Monitor accounts receivable aging

Review the A/R aging report at least weekly to identify any accounts that are becoming overdue. This report is instrumental in tracking the length of outstanding invoices and helps prioritize follow-up actions with customers who have past-due balances.

Accounts Receivable Reconciliation Process at Month-End

.webp)

Building on the ongoing reconciliation practices, the month-end A/R reconciliation process is crucial for ensuring comprehensive financial accuracy.

Here your focus is confirming that all AR activity has been properly recorded. The basic steps to the monthly accounts receivable reconciliation process are as follows:

1. Review the previous month’s balance

Begin by ensuring that the beginning balance on your accounts receivable report aligns with the ending balance reported on the previous month's financial statements. Regular daily and weekly reviews should minimize discrepancies, but this step ensures any remaining errors are identified and fixed.

2. Cross reference your general ledger balance and unpaid customer billings from the sales ledger

First, determine where you are recording open invoices and noting when people have paid in the reconciliation report. This may involve referencing:

- An AR Aging report from your ERP: If you’re actively sending invoices through Quickbooks, NetSuite, etc. you’ll tie your A/R TB directly to the total of unpaid customer billings in your A/R Aging report.

- A separate invoicing system: If instead, you’re actively sending invoices and receiving payment through a system like Stripe, you’ll use this directly as a sales ledger and reference the unpaid invoice total to compare to the A/R TB total.

- A manual A/R workpaper: Finally, if for whatever reason none of your core systems are a reliable source of truth for invoice payment status, some accounting teams manually keep track of open invoices and A/R aging in an Excel workpaper. If you’re building a workpaper in spreadsheets from scratch, you can start with our A/R Reconciliation Template.

Regardless of source, you’re tying out the total of unpaid customer billings to the general ledger A/R balance.

Note: Later in the month-end close process, as a part of bank reconciliation, you’ll also ensure that all transactions in bank statements align with the total from paid customer invoices.

3. Prepare to correct any discrepancies

If your sales ledger and GL do not tie out, the next step is investigating irregularities between the transactions and the entries in your general ledger. Prepare documentation and justifications for adjustments that may need to be made to resolve these discrepancies, aiming to align your documented evidence with your ledger entries.

A few ways variances and errors could occur due to the following:

- A payment was applied twice.

- The payment was applied to the wrong customer account.

- The amount was transposed when input into the general ledger.

- The A/R journal entry was reversed when the payment was applied (e.g., the A/R account was debited vs. credited).

Significant discrepancies should be rare if you also apply an ongoing daily or weekly reconciliation of accounts receivable when matching payments and invoices. However, this step ensures all data aligns as perfectly as possible across your financial records.

If using Numeric for account reconciliation, in this step you’ll cross the GL balance automatically pulled in and can drill into transactions to pinpoint any discrepancies.

4. Update the general ledger and record any allowance/bad debt expense

After identifying and resolving any discrepancies, update the general ledger to reflect the adjusted totals. When reviewing the A/R aging report, scan for any invoices that meet the requirements for bad debt expenses/allowance and record accordingly.

This ensures that the ledger accurately represents the actual A/R status after accounting for all corrections made during the reconciliation process.

5. Perform a final review

Finally, review the sales ledger and the general ledger one last time to confirm that all corrections have been accurately recorded and are reflected in the updated ledger.

This final check is crucial to confirm the integrity of the reconciliation and to ensure that your financial reports will be free of discrepancies related to accounts receivable.

Notably, the diligent application of daily and weekly reconciliation tasks significantly streamlines the month-end process. Combined, these A/R reconciliation processes ensure the month-end financial statements are accurate and reflective of the company’s true financial status.

Accounts Receivable Reconciliation Example

The following example illustrates how the reconciliation process might work for a company that performs both ongoing and month-end accounts receivable reconciliations, with two different employees responsible for each task.

Two staff members, Jordan and Alex, are tasked with these responsibilities. This segregation of duties helps maintain internal controls and ensures accuracy throughout the process.

Weekly Reconciliation by Jordan

Jordan handles the weekly A/R reconciliation tasks for our example company. Each week, he:

- Collect weekly documentation: Gather all invoices issued, payments received, and adjustment notes made during the week.

- Verify transactions: Apply each payment received against the invoice to ensure all payments are recorded correctly and invoices are accounted for, scanning to confirm that pricing, dates, products, etc. align.

- Identify discrepancies: Spot discrepancies, such as unrecorded payments or erroneous invoice amounts. Immediate identification allows for quicker resolution and maintains accurate cash flow reporting.

- Document findings: Maintain a weekly log of A/R reconciliation activities, noting any discrepancies and the actions taken to resolve them.

All the weekly documents reviewed and prepared by Jordan are maintained in a central area. By keeping the documents well-organized, it’s easier to perform the month-end reconciliation tasks.

Month-end reconciliation by Jordan and Alex

Alex and Jordan perform the month-end reconciliation as part of the closing process. At the end of each month:

Preparer (Jordan):

- Reconcile month-end balance: Given that the company issues all invoices and collects payments in Stripe, Jordan cross references the total of unpaid customer billings in Stripe with the downloaded A/R trial balance. Jordan uploads the Stripe documentation and signs off on the reconciliation, providing a clear audit trail.

- Review triggered by specific customers and days outstanding: Jordan then scans through any transactions that are associated with point customers that are prone to overpaying or underpaying and records any allowance or bad debt expense as needed.

- Confirm proper tie out to the GL: After making any adjustments, Jordan then ensures proper tie out to the GL.

Reviewer (Alex):

- Review weekly logs: Alex examines Jordan's logs and records to ensure completeness and gain an overview of the weekly activities.

- Ensures proper documentation for any JE’s booked: Alex confirms that all JE’s and estimates around allowance for doubtful accounts have proper documentation.

- Reviews aging report and reconciliation: Alex ensures that aging agrees to the general ledger and that there are no unusual items in the aging report.

By having Jordan manage the frequent, detailed checks and Alex oversee the broader, strategic month-end reviews, the company ensures a comprehensive oversight of its ongoing and periodic A/R reconciliation activities, enhancing the integrity and accuracy of its financial reporting.

Best Practices for Accounts Receivable Reconciliation

Effective accounts receivable reconciliation not only helps keep your financial records in good shape but also supports your company's financial health.

Here are some accounts receivable best practices you can apply to your reconciliation process:

- Regularly review your accounts receivable: Make reviewing your accounts receivable a routine task, not just part of the month-end close process. Regular scrutiny helps detect discrepancies early, making them easier to manage and resolve.

- Assign the task to multiple people: Rotate the responsibility for ongoing reviews and month-end reconciliations among different staff members. This practice is a key internal control measure to prevent fraud and promote accuracy.

- Keep meticulous records: Maintain thorough accounting records of all invoices, receipts, and communications. Not only does accurate documentation support effective reconciliation, but it can be invaluable in resolving disputes or accounting record audits.

- Proactively contact customers: Engage with customers with past due invoices as soon as possible. Early communication can help resolve issues before they escalate, improving cash flow and customer relationships.

- Use automation tools: Implement A/R automation software to streamline invoicing, payment tracking, and reconciliation tasks. Automation potentially reduces human error and eliminates time-consuming work.

- Regularly review your reconciliation procedures: Continuously refine and update your processes to address new financial practices and technologies. This can prevent discrepancies and align with best accounting practices.These best practices are designed to keep your accounts receivable management efficient, accurate, and reliable, helping your business maintain solid financial footing.

Common Challenges with AR Reconciliation

A/R account reconciliations are critical to ensuring the accuracy and reliability of the company’s financial statements.

Even so, several challenges can complicate this process, potentially leading to discrepancies and financial reporting errors. Recognizing these common challenges is the first step towards mitigating their impact and enhancing the effectiveness of your reconciliation efforts.

Some common challenges businesses may encounter during the A/R reconciliation process are:

Failing to allocate time

One of the primary challenges with accounts receivable reconciliation is the failure to allocate sufficient time for this crucial task. Regular reconciliation requires consistent attention and time investment, which can be overlooked in a busy work environment.

Neglecting this task can lead to a backlog of unreconciled items, making it harder to catch and correct errors promptly.

Overloading a single individual

If you have a small staff, you might be tempted to assign the reconciliation processes to one person. However, having one person handle all aspects of accounts receivable—from issuing invoices to reconciliation—poses significant risks.

Not only does this create a potential for fraud, but it can also overwhelm the assigned individual, increasing the likelihood of mistakes due to fatigue or oversight. Implementing separation of duties for this task is essential for both accuracy and adequate internal controls.

Disorganized documentation

Maintaining organized documentation is fundamental to efficient reconciliation. Disorganized records can lead to significant delays in reconciling accounts and resolving discrepancies.

It’s crucial to keep all related documentation, including invoices, receipts, and payment confirmations, filed in a well-organized way and easily accessible.

Inadequate use of technology

Another challenge is the inadequate use of technology in the reconciliation process. Relying on manual methods in today's fast-paced environment can be inefficient and error-prone.

Modern accounting software and automation tools can significantly streamline the reconciliation process, reduce errors, and improve efficiency.

Tools Available to Automate Accounts Receivable Reconciliation

Ultimately, the tools (if any) you use to automate the accounts receivable reconciliation process will depend on how you maintain your accounting records.

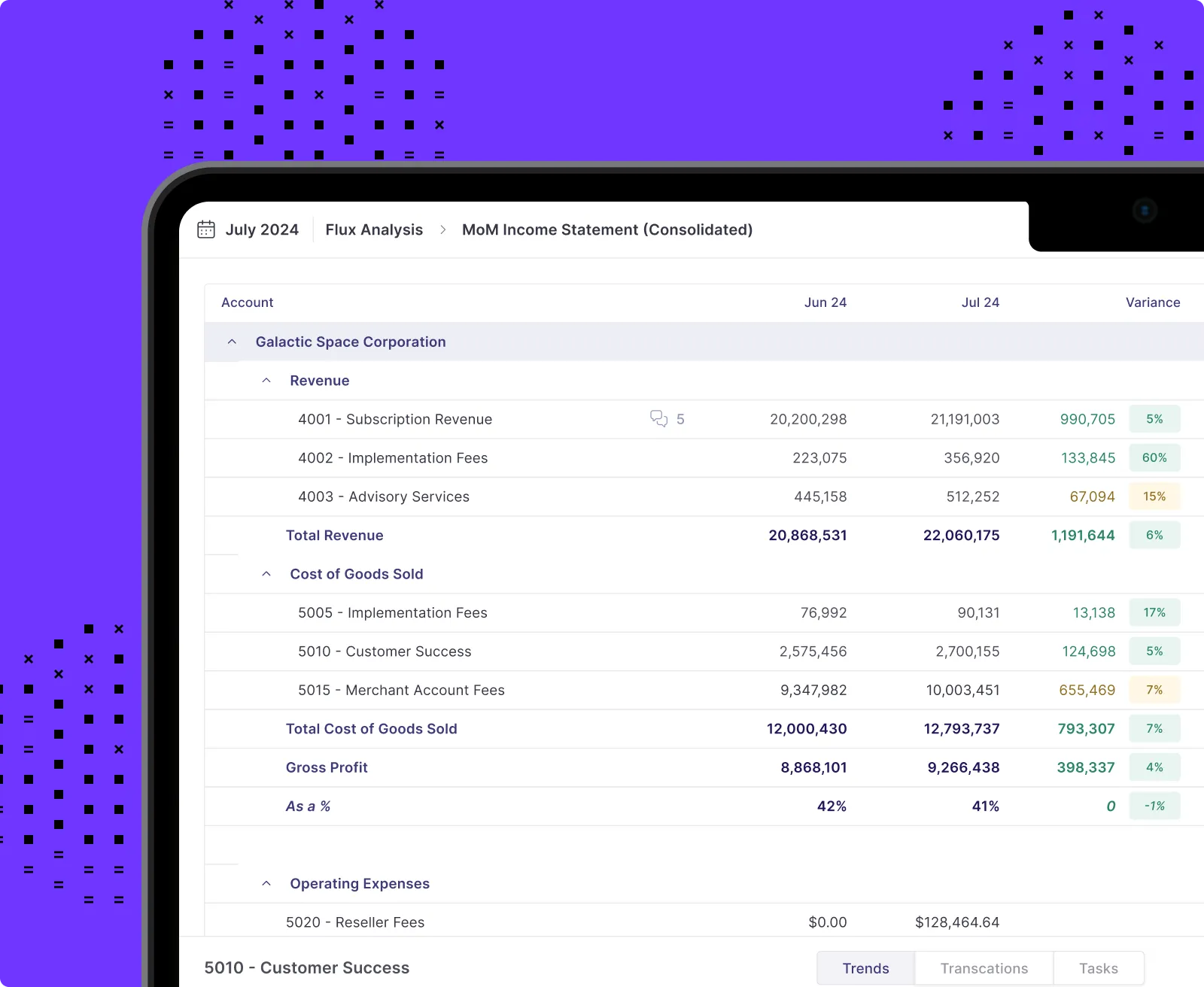

We’ve broken out options for your accounting tech stack to consider for A/R reconciliation and beyond. For balance sheet reconciliations specifically, leading companies using Numeric to organize their month-end close and automatically pull in their GL trial balance to compare with their sales ledger and ensure a clear audit trail is in place.

How Numeric Helps with Accounts Receivable Reconciliation

Numeric helps accounting teams manage fast, audit-ready month-end closes with AI and automation. For AP Reconciliation, Numeric helps teams:

- Manage balance sheet reconciliations in a single place: For month-end A/R recs, teams upload their A/R aging report or other sales ledger balance to tie out with the trial balance automatically pulled from their GL. With a deep ERP integration, Numeric users can click into underlying A/R transactions to investigate. Prior period balance monitoring also catches any changes since accounts were reconciled.

- Remain organized and audit-ready with clear controls and documentation: Assign reviewers and preparers of A/R reconciliation tasks and capture all comments, changes, and task submissions. Auditors then directly log-into Numeric with a clear activity trail, no need for your team to spend hours resurfacing required documentation.

- Report easily on A/R transactions and enable FP&A: Pivoting transactions by customer? Grouping by class? Numeric integrates every transaction line from your ERP to enable quick reporting as a part of the month-end close process. With view-only access roles included in all accounts, FP&A teams can check actuals directly in Numeric to monitor how much was spent and monitor cash flow without needing to contact the accounting team prematurely.

- Set-up ongoing transaction monitoring: With Monitors, you can flexibly set-up ongoing alerts. Catch any transactions tied to particular customers or, for Controllers doing a quality check of the full month-end process, surface all journal entries booked to A/R to scan through.

FAQ on Accounts Receivable Reconciliation

How often should you reconcile accounts receivable?

For ongoing A/R reconciliation (applying payments to invoices and spotting any discrepancies), it’s a good practice to reconcile daily or weekly.

In addition, you should generally reconcile your accounts receivable to the general ledger on a monthly basis. This reconciliation will correspond to the frequency with which you close your books and prepare your financial statements, as it’s part of the closing process.

Ultimately, the frequency of your A/R reconciliation will depend on factors such as your company's complexity, the size of your receivables, and any third-party requirements (such as how often your lenders want to review your financial statements).

What’s an AR aging report?

An A/R aging report is a detailed listing of your accounts receivable, showing how long the balance has been outstanding (unpaid). In general, the “age” of your A/R is measured in days.

In many cases, the age of your A/R is measured from the invoice due date. The individual A/R ages will often be placed into categories that include current invoices (those not yet past due), 1-30 days past due, 31-60 days past due, 61-90 days past due, and over 90 days past due.

The Bottom Line on Accounts Receivable Reconciliation

Accounts receivable reconciliation is a crucial part of financial management for any business and involves ongoing reconciliation applying payments to invoices and reconciliation between the GL balance and the total of unpaid billings from your sales ledger.

Adopting a structured approach to reconciliation not only helps in identifying discrepancies early but also facilitates timely corrections in financial records and supports effective cash flow management.

.png)

.png)

.png)