General Ledger Reconciliations: How to Conduct GL Recs

.webp)

Accurate financial data isn’t just a luxury – it’s a necessity. When numbers go awry, an avalanche of financial issues come in its wake meaning that reporting, decision-making, and more are thrown into chaos.

Thankfully, that’s where general ledger reconciliation comes into play. By comparing the general ledger to supporting documents, businesses can ensure their accounting records are correct, leaving no room for costly errors or audit surprises.

In this article, we’ll walk through the importance of general ledger reconciliation, how it works, and why it’s a critical practice for maintaining your company’s financial health.

What is General Ledger Reconciliation?

General ledger reconciliation is a key accounting process that involves verifying that the balances in your general ledger are accurate and match external documents and workpapers. In doing so, teams ensure that their financial records are correct and reliable.

So, what does that process look like? In practice, teams reconcile their general ledger (GL) by performing account reconciliation on the accounts listed across the ledger. A team will rarely reconcile every GL account, instead choosing to focus on key accounts like those that might show up on a balance sheet or P&L statement.

What are the main categories of general ledger accounts?

General ledger accounts fall into five main categories; each plays a distinct role in capturing different aspects of a company’s financial activities.

- Assets

- Cash: Money available in bank accounts

- Accounts Receivable: Money owed by customers for goods or services delivered

- Inventory: Goods available for sale

- Fixed Assets: Long-term assets like machinery, buildings, and vehicles

- Liabilities

- Accounts Payable: Money the business owes to suppliers.

- Notes Payable: Loans and other forms of credit the company must repay.

- Accrued Expenses: Expenses that have been incurred but not yet paid.

- Customer Deposits: Money received from customers before delivering goods or services.

- Equity

- Common Stock: Capital invested by shareholders.

- Retained Earnings: Profits reinvested in the business rather than distributed as dividends.

- Preferred Stock: A class of ownership with a fixed dividend, before common stock dividends.

- Treasury Stock: Shares repurchased by the company.

- Expenses

- Rent: Costs for leasing business premises.

- Salaries and Wages: Payments to employees.

- Utilities: Costs for electricity, water, and other services.

- Advertising/Marketing: Money spent on promoting the business.

- Revenue/Income

- Sales Revenue: Income from selling products.

- Service Revenue: Earnings from providing services.

- Interest Income: Earnings from interest on investments.

- Rental Income: Earnings from leasing property.

Are general ledger reconciliation and balance sheet reconciliation the same?

It’s a classic case of the “Is every rectangle a square?” In this instance, GL recs are the rectangle; balance sheet recs are the square.

Reconciling an account on the general ledger may also benefit the process of reconciling the balance sheet. However, the balance sheet generally is only concerned with the equity, liabilities, and asset accounts.

So, for example, conducting accounts receivable reconciliation is a necessary part of any general ledger and balance sheet recs. But expense and revenue accounts only appear on the general ledger, so reconciling those accounts has no bearing on the balance sheet.

Stated simply, any account in a balance sheet reconciliation fits under the umbrella of general ledger reconciliations. Not every account in general ledger reconciliations are part of balance sheet reconciliations.

What are common types of general ledger reconciliations?

Understanding common examples of general ledger reconciliations helps to grasp its practical applications. Here are some key types of reconciliations:

- Fixed asset reconciliation: compares GL trial balance with fixed asset subledger totals

- Accounts payable reconciliation: typically matches trial balance from your AP ledger and your AP aging report

- Accounts receivable reconciliation: matches AR ledger balance with unpaid sales invoices

- Bank reconciliation: aligns cash accounts ledger balances with bank statements

These examples highlight the importance of regular reconciliation across various aspects of financial management, a fundamental step for ensuring that every financial transaction is accurately recorded and verified.

How Often Should I Perform General Ledger Reconciliation?

Many companies make GL recs a core part of their month-end close and aim to reconcile around 70% of these accounts monthly before having to complete full reconciliations during audits.

Initially, teams should focus on reconciling core accounts. Then over time as the company matures, they should aim to increase the percentage of accounts reconciled to ensure full confidence across the general ledger.

Why is General Ledger Reconciliation Important?

Performing general ledger reconciliations is more than just a routine task – it is an internal control that proves essential for maintaining accurate, reliable, and fraud-free financial records, which support effective P&L management.

Here are some other core reasons for why you should reconcile your GL:

- Ensures Completeness and Accuracy of Account Balances: General ledger reconciliation confirms that all transactions are accurately recorded. If you buy inventory worth $1,000, this transaction should appear in both your general ledger as well as the supporting register where inventory transactions are stored. Reconciliation ensures these amounts match, catching any discrepancies immediately. Without this step, unnoticed errors could lead to incorrect account balances.

- Helps in the Preparation of Reliable Financial Statements: Financial statements like balance sheets and income statements depend on accurate general ledger data. Imagine preparing an income statement without verifying your revenues and expenses first. Inaccuracies in these statements can mislead stakeholders. Regular reconciliation ensures your financial statements reflect the true financial position of your business.

- Prevents Errors and Identifies Fraud: Errors in financial records can arise from simple mistakes, like entering the wrong amount, or from more serious issues, like fraud. General ledger reconciliation catches these errors early.

- Maintains the Integrity of the General Ledger: The general ledger serves as the backbone of your financial records since every financial transaction flows through it. Ensuring the accuracy of your GL is critical for maintaining trust and integrity in your financial data.

The 6 Key Steps of the General Ledger Reconciliation Process

Step 1: Identify the Accounts to Be Reconciled

Begin by pinpointing the specific accounts that need reconciliation – prioritize accounts with high transaction volumes or those crucial for financial statements.

Identifying them ensures you cover all critical areas where discrepancies might occur. Often companies will start with core accounts like cash, deferred revenue, payroll, and AR/AP.

Step 2: Gather Necessary Details from Transaction Sources

Collect all relevant documents.

This includes bank statements, workpapers, or downloaded reports you’ll use to substantiate the recon. Ensure you have access to any subledger information that corresponds to your general ledger accounts.

For teams on Numeric, the trial balance and supporting document total will auto-populate each month, no need to download.

Having accurate and comprehensive records helps in cross-verifying transactions and balances. Without these documents, reconciliation becomes guesswork, leading to potential errors.

Step 3: Compare the Information

With all documents in hand, the next step is comparison: compare the total from your general ledger with the supporting documents. If the totals in your workpapers tie out with the GL, then you can assume that the corresponding account is balanced. If not, you’ll have to look for any mismatches between the ledger entries and the supporting sources.

Step 4: Investigate Discrepancies

Dive deeper into any discrepancies found. Look into your own accounting processes to identify any procedural errors. Determine if they are due to timing differences, data entry errors, or potential fraud. Decide on the necessary steps to correct these discrepancies, whether through further verification or adjustments.

Step 5: Prepare and Post Adjusting Journal Entries

If corrections are needed, prepare journal entries to adjust the account balances. For instance, if a transaction was recorded twice, an adjusting entry will remove one of the entries. Post these adjustments to ensure the general ledger reflects accurate balances.

Step 6: Retain Documentation for Future Reference:

Maintain all documentation related to the reconciliation process. This includes the original transaction records, notes on discrepancies, and copies of adjusting journal entries.

Documenting the reconciliation is vital for future reference and audits. It provides a clear trail of the steps taken and the adjustments made, ensuring transparency and accountability in your financial reporting.

For teams on Numeric, a full audit trail of preparer, reviewers, comments, and action taken will automatically be stored.

Common Errors in General Ledger Reconciliation

Despite even the most thorough procedures, errors in general ledger reconciliation can still occur. Understanding these common mistakes can help you avoid them and maintain accurate financial records.

Unchecked, Missing or Mislabeled Transactions

Discrepancies in accounting are like seeds for future disappointment & frustration – if you don’t stop them at the root, they will grow into massive headaches down the road. As such, timeliness is crucial for catching errors early and ensuring your financial data stays current.

Numeric’s Monitors feature allows teams to set up alerts that flag missing, incorrect, or miscoded transactions, alleviating the anxiety that comes from finding out one discrepancy will cause you a mountain of work after the fact.

Duplicate Entries

Duplicate entries often result from poor coordination among team members or automated systems. To mitigate this confusion, teams should add a human in the loop for workflows like automated bank matching to manually review outputs for duplicate entries.

Similarly, tasks should be properly delegated across team members to avoid overlapping duties. Fortunately, Numeric’s close checklist tools help to enhance collaboration by a) separating tasks into preparer, reviewer, and even an optional second reviewer and b) introducing dependencies that block certain close tasks from being started until a preceding one is finished.

Incorrect Coding

Coding a transaction for AR instead of AP is an easy recipe for a reconciliation mess – you’ve allocated money owed to money earned! These kinds of errors not only throw off account balances but also require adjusting entries to be made across multiple accounts in the GL.

Faulty coding can typically be attributed to a lack of proper training or a complex chart of accounts that increases the likelihood of errors. To prevent coding mistakes, accounting managers should provide thorough training to staff accountants and keep the account structure as simple as possible to reduce coding errors.

By being aware of these common errors, you can implement strategies to avoid them and maintain accurate and reliable financial records.

Frequently Asked Questions (FAQ)

How do you reconcile the general ledger and a subledger?

Reconciling the GL with a subsidiary ledger, or subledger, doesn’t look very different from most other reconciliation procedures. Generally, teams follow these steps:

- Compare Balances: Start by comparing the general ledger balance with that in the subledger.

- Investigate Differences: When you find differences between the general ledger and the subledger, investigate their causes.

- Adjust Entries: Once you’ve identified the discrepancies, make the necessary adjustments in both ledgers to correct the errors.

- Verify Adjusted Balances: After making adjustments, verify that the balances in both ledgers are now accurate and match each other.

With these steps, you can ensure that both ledgers match and reflect true financial data.

Why Teams Should Automate General Ledger Reconciliation

Getting your balances to tie out is truly gratifying: not only have you found the needle(s) in the haystack, but you’ve also ensured that your company is free from fraud or missing transactions.

That description unfortunately only paints reconciliation with the rosiest of glasses. For many accountants, reconciling GL accounts is a painstaking exercise, one that takes hours to identify the transactions keeping dozens or more accounts out of balance.

The solution? Automated general ledger reconciliation. With account reconciliation software like Numeric, teams are able to streamline the reconciliation process since automation simplifies these steps:

- Data Gathering: Automatically pull data from multiple sources like bank statements and subledgers.

- Automatic Certification: Auto-submit reconciliations that tie out or have variances below your materiality threshold

- Discrepancy Identification: Quickly flag inconsistencies for review and identify the exact transaction that results in an account no longer reconciling.

- Consistent Documentation: Automatically store and organize all relevant documents, making them easy to retrieve and review, especially for audit.

- Enhanced Collaboration: Allow multiple users to access and work on the same data simultaneously, improving teamwork.

How Numeric Helps Accounting Teams with GL Reconciliation

Want to see how a team using Numeric improved their GL recs and shaved days off their close? Check out our case study with the team at Soundstripe.

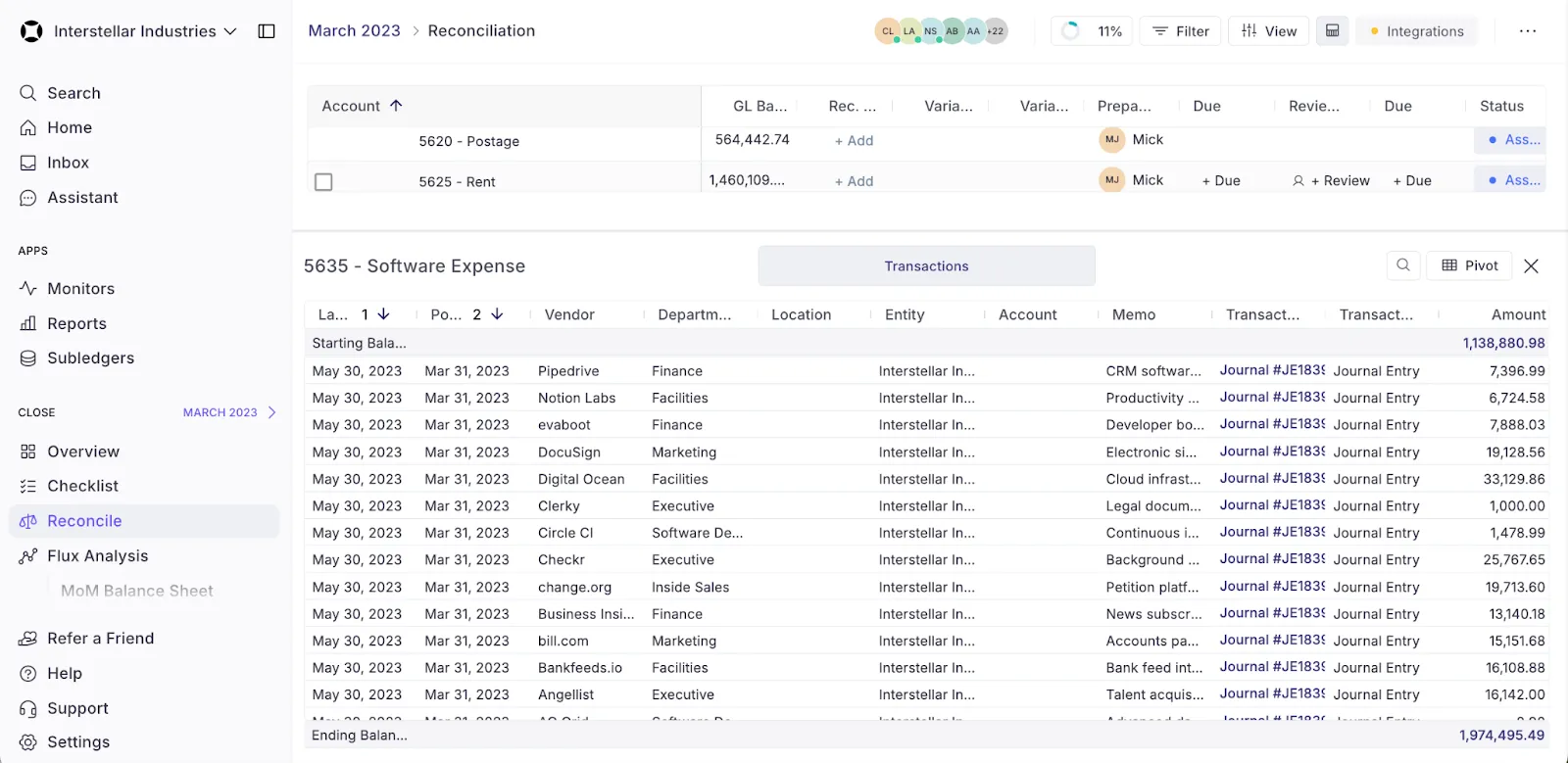

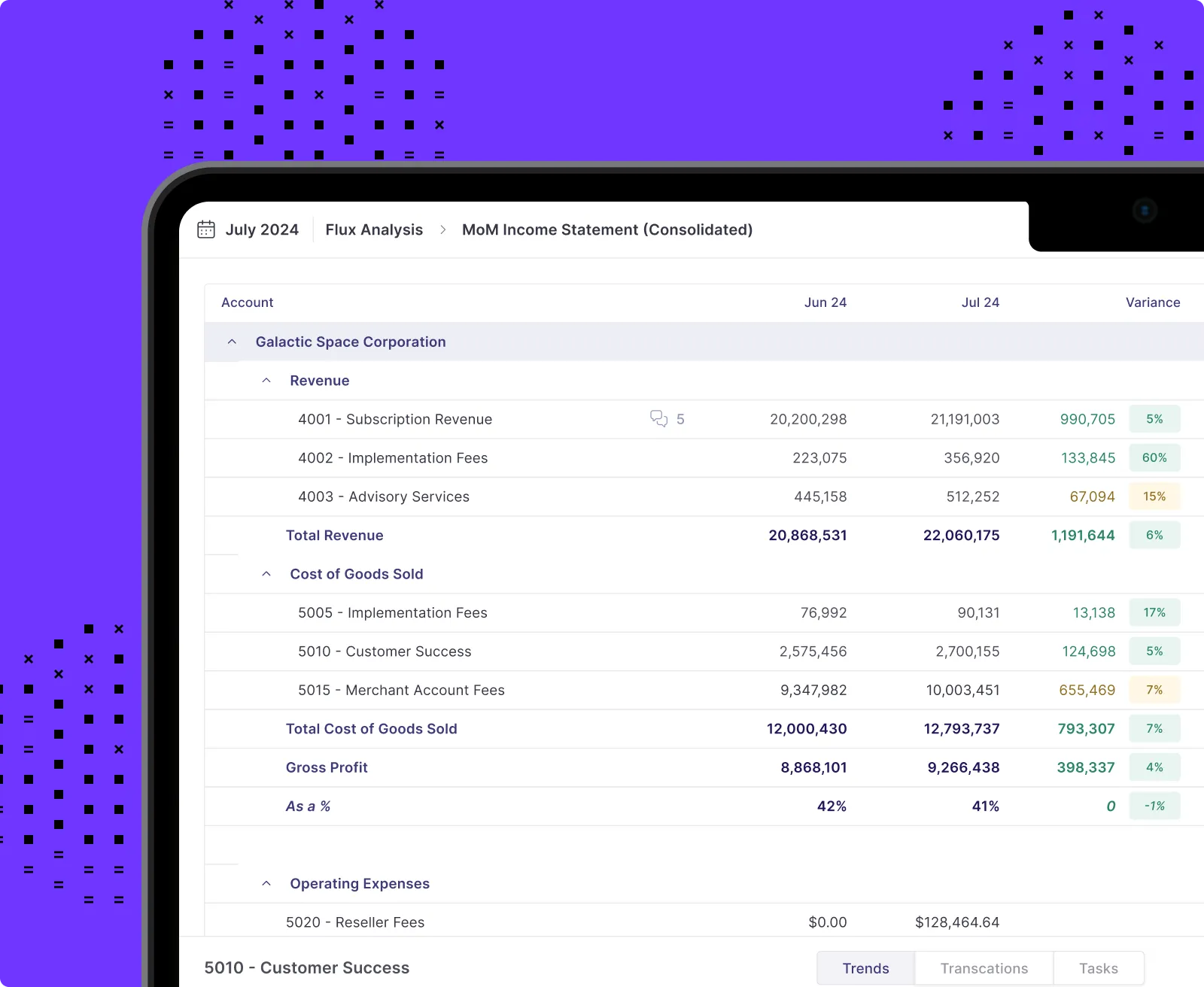

- Streamline your balance sheet reconciliations: With Numeric, you can handle all your month-end balance sheet recs in one spot. The system automatically pulls account totals from workpapers and your GL's trial balance. Even better, with a deep ERP integration, Numeric users can click into underlying transactions across accounts to investigate. Numeric also monitors prior period balances, flagging any changes since your last reconciliation.

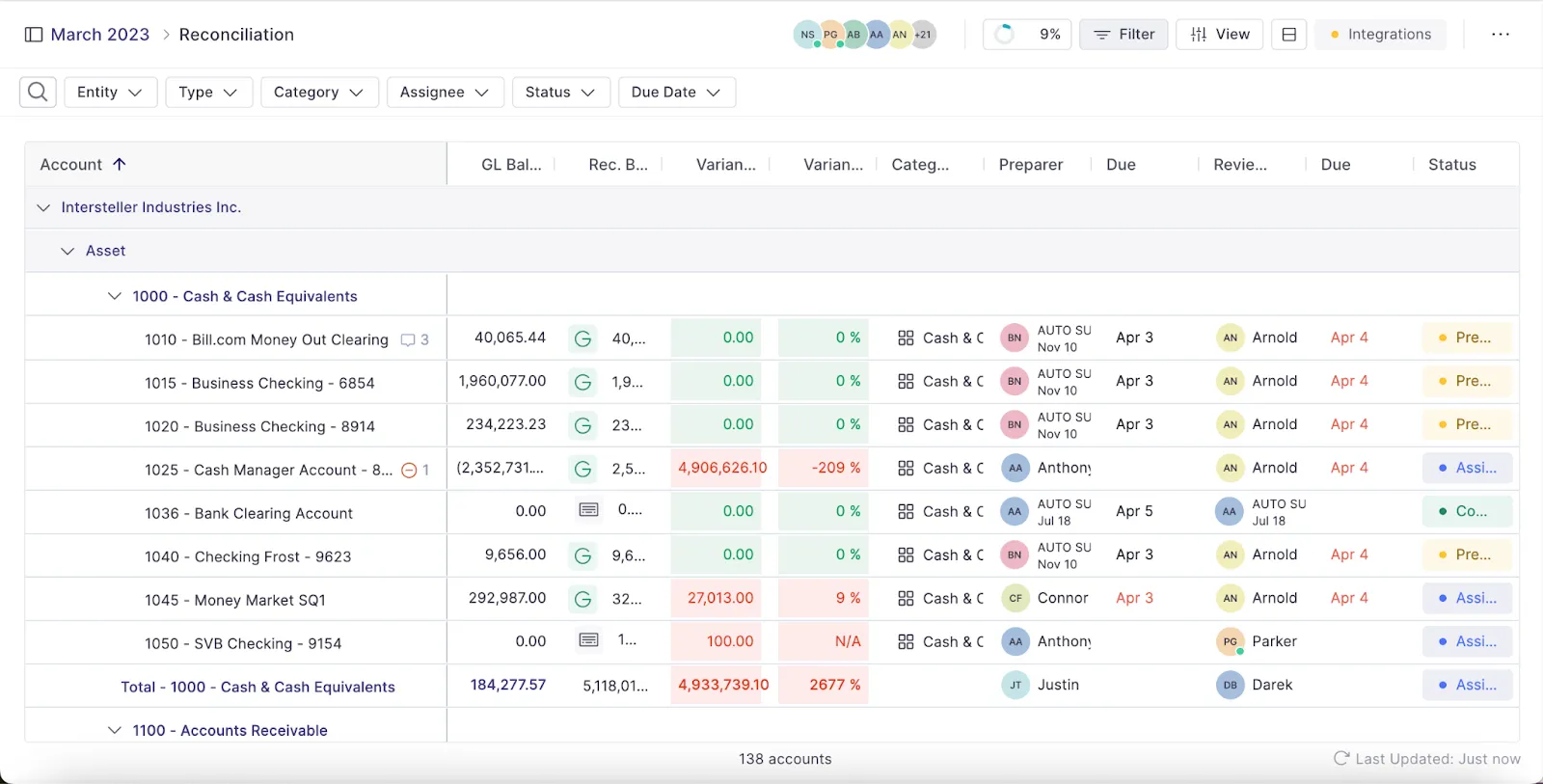

- Stay organized and audit-ready with clear controls and documentation: Numeric makes it easy to assign reconciliation tasks to preparers and reviewers, and keeps track of all comments, changes, and submissions in a clear month-end close checklist. When audit time rolls around, auditors can log straight into Numeric and see a complete activity trail, no need for your team to spend hours resurfacing required documentation.

- Set-up ongoing transaction monitoring: With Monitors, you can flexibly set-up ongoing alerts to catch errors ahead of month-end account reconciliations. Catch any transactions tied to particular customers or, for Controllers doing a quality check of the full month-end process, surface all journal entries booked to A/R to scan through.

The Bottom Line

Reconciling the general ledger is like being told to eat your vegetables – you may not want to, but you always know it’s in your best interest. By regularly performing these reconciliations, businesses can ensure that their financial data remains reliable, audit-ready, and aligned with overall business goals.

Schedule a demo to see how Numeric can streamline your recs for a faster and more accurate close.

.png)

.png)

.png)