Numeric's Transaction Monitors: 10 Time-Saving Alerts to Build

.png)

Curious what's ahead? Here's what we'll cover:

- Fewer Surprises, Greater Certainty

- Monitors: A Path Toward the Proactive Close

- 10 Transaction Monitors Your Team Can Build

Fewer Surprises, Greater Certainty

To keep financial accuracy high, you naturally have to keep surprises low. But when unexpected bank fees, anomaly transactions, or novice accountants are a part of the game, surprises are to be somewhat expected.

The best accounting teams don’t sweat it, though — instead of playing finance Whack-a-Mole each close, they rely on proactive monitoring systems like Numeric’s Transaction Monitors.

Specifically, monitors are a real-time alerting framework on your NetSuite data: teams set up monitors to automatically alert them for transactions that a human would want to review – no need to remember what entries need to be checked and no reason to fear forgetting them either.

If you’re looking for ways to improve your close process or are curious about cutting-edge tools that are reshaping accounting, keep reading to see why monitors are a game-changer for the accounting teams of the future.

Monitors: A Path Toward the Proactive Close

Monitors move teams toward more real-time accounting.

Truly, that’s the entire reason they exist. Let’s take a step back and think about the month-end close process.

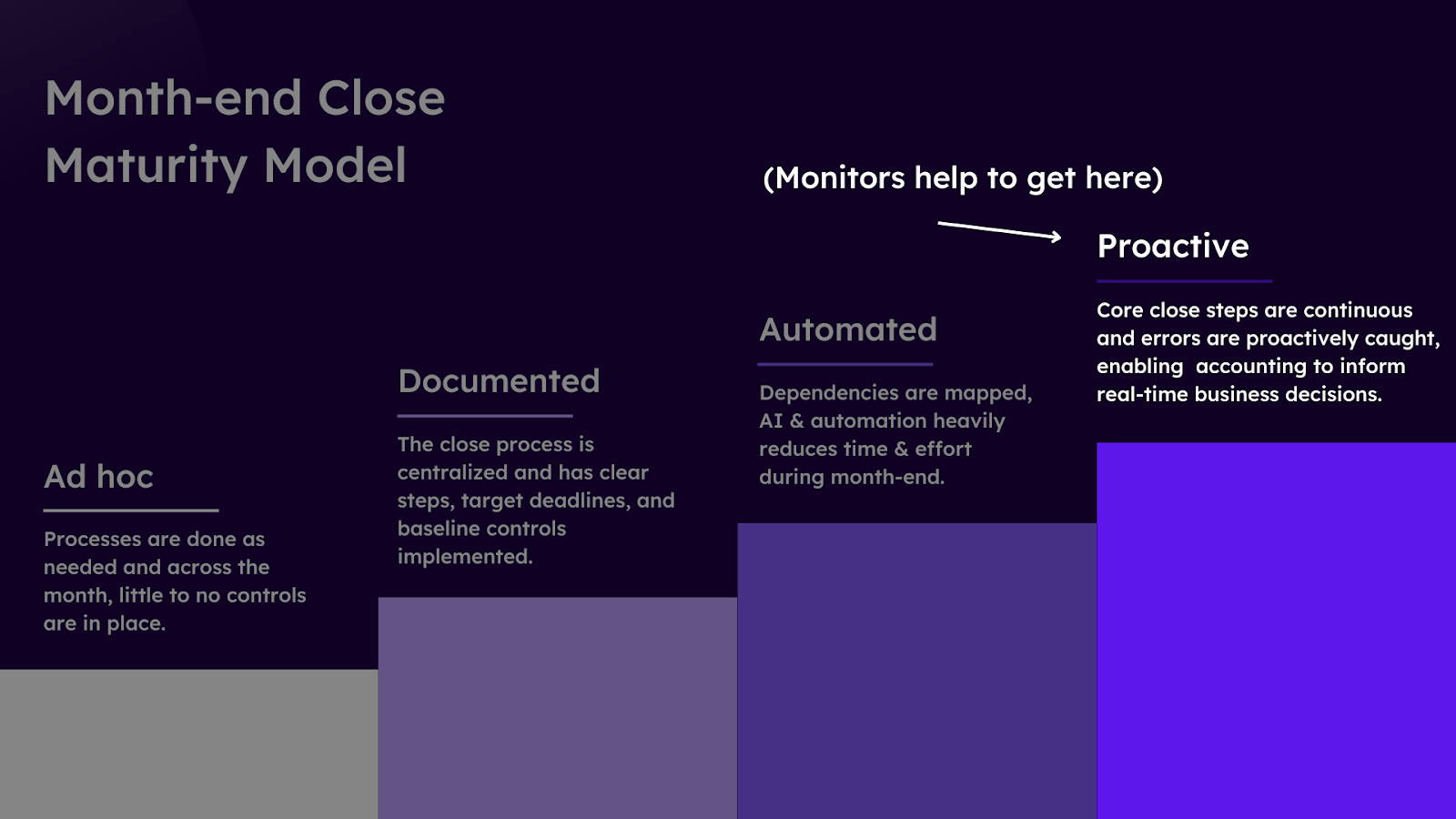

We can look at the average accounting team’s close process as a journey of progress: one that begins with laying the groundwork, then moving toward steady improvement, and ultimately reaching peak performance. For some teams, this begins with establishing basic processes — laying the groundwork. From there, they build consistency and efficiency — steady improvement. And for teams already excelling, our goal is to help them achieve a proactive close — peak performance.

High performance accounting teams only achieve proactive, or continual, closes by bringing typical month-end close procedures further up into and across the month, an attempt to make them happen in as real-time as possible. Monitors are a means to that end.

For more on adopting a proactive close mindset, see Episode 1 of Incoming Statements with Nate Carbrey, VP, Global Corporate Controller of Paddle:

We see teams using monitors typically in two ways – either for enforcing policies & procedures or for detecting anomalies.

Confused what that might look like? Here are two examples of monitors in practice:

- Errors and Anomalies: Instead of realizing that a transaction was tagged without a vendor during month-end reconciliations, teams on Numeric can create a monitor that will flag all transactions listed without vendors.

- Policies and Procedures: Here, we’ll see teams set up a monitor that flags every time a $5000+ transaction hits a furniture/fixture account as an instance where the team should account for the transaction with their fixed asset policy.

Monitors can also benefit managers and external stakeholders:

- FP&A + Monitors: Maybe your FP&A team flags a certain set of transactions every close. To help them (and frankly, yourself), set up a monitor that spots these transaction types so that you catch them proactively rather than having to dig for them later on.

- Controllers + Monitors: Need to implement some quality control on your growing accounting team? Easy – Controllers can create a monitor that shows when anyone posts a JE to cash, for instance, so that they can jump in and investigate.

So, what’s the overarching goal of monitors?

Monitors work to establish real-time accounting checks to alleviate the pressure tied to trying to compress everything into a 1-2 week month-end close.

The #1 Cash Management Tool for Accounting Teams

How to Build a Transaction Monitor in Numeric

If you've fought tooth and nail to finally understand how to build Saved Searches in NetSuite, then Numeric's Monitors builder will feel far more intuitive and still quite familiar. (If you're still fighting, we can help – check out our Guide to NetSuite for Saved Search best practices!)

For transactions or other GL-impacting data you want to monitor, add the conditions or filters of your search. Transactions directly from your NetSuite instance will populate so you can tell in real-time if your search is acting as it should. Once you've confirmed that you're looking at the right data, save the monitor and you're good to go.

10 Transaction Monitors Your Team Can Build Today

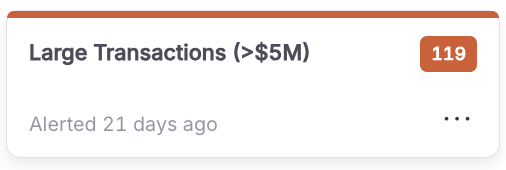

- Large Transactions Over/Under/Equal To a Certain Amount

How It Works:

This monitor flags large transactions that exceed, fall below, or are equal to a specified amount. It can be applied to specific accounts or across all accounts for increased visibility.

How to Build:

Create a condition where the amount is greater than, less than, or equal to a set value. For example, set the condition as “Amount >= $1,000,000” to capture any large transactions. In this example, the monitor searches for expense transactions from a software expense account over a set $ value.

Why It’s Useful

If your company rarely sees transactions over $1,000,000, this monitor ensures you are alerted whenever a transaction of that size posts to the GL, allowing you to review it promptly for accuracy or unusual activity.

- Unexpected Transaction Type Monitor/ Journal Entries to Cash

How It Works:

This monitor flags any unusual transaction types posted to specific accounts, such as manual journal entries posted directly to cash or payroll accounts.

How to Build:

Choose the relevant account(s) (e.g., cash or payroll) or and set a condition for a transaction type that is unexpected for that account, such as a manual journal entry or any other non-standard transaction type.

In this example, which represents JEs to Cash, the transaction type is set to “journal”, indicating that the monitor will filter for any journal entries posted, and then the account is set to the seven cash accounts for this entity, but it very well could be for only one account as well.

Why It’s Useful

This is especially helpful for Controllers or senior accountants who need to oversee quality control during the close process, ensuring that junior staff aren’t introducing irregularities by posting unusual transactions to sensitive accounts like cash.

- Expenses Missing Department and/or Vendor

How It Works:

This monitor flags any transactions in expense accounts that are not coded to a department or vendor.

How to Build:

Set two conditions: one to capture transactions where the department is missing, and another with an "OR" condition to flag transactions missing a vendor.

Why It’s Useful

Instead of manually reviewing each transaction to confirm it’s properly coded, this monitor acts as a safeguard, ensuring that all expense transactions have both department and vendor information included.

- Department P&L Monitor/ Missing Departments for Revenues & Expenses

How It Works:

Monitor looks at revenue/expense accounts and flags if any are not coded to a department.

How to Build:

Set a condition for “account type” to [Revenue, Expense] to include all revenue and expense accounts. Then, add a condition to see where the accounts have an empty department.

Why It’s Useful

Accurate department coding is essential for proper financial statement line item (FSLI) reporting on the P&L. This monitor ensures that all transactions are correctly linked to their respective departments, which is crucial for departmental tracking and reporting accuracy.

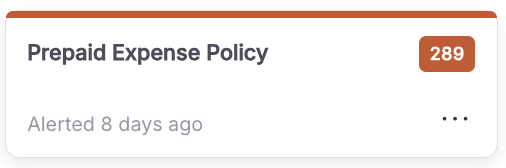

- Prepaid Expense Monitor

How It Works:

This monitor flags transactions in an expense account that exceed your company’s capitalization threshold.

How to Build:

Set the condition to identify any transactions in the specified expense account where the amount is greater than your capitalization threshold.

Why It’s Useful

This monitor helps catch transactions that should be classified as prepaid expenses, ensuring that these amounts are capitalized and treated according to your company's prepaid expense policy. Since many companies tend to purchase software on a subscription basis, this monitor is ideal for software expense accounts.

- Fixed Assets Monitor

How It Works:

This monitor flags transactions in accounts related to office expenses, furniture and fixtures, computers, and similar items, helping to detect expenses that may need to be reclassified as fixed assets for amortization and depreciation.

How to Build:

Set conditions to monitor relevant expense accounts, focusing on specific asset categories such as furniture, equipment, or computers. Then, set the amortization threshold. In this example, the account is for computer hardware and the threshold is set for transactions that surpass $2,000.

Why It’s Useful

This monitor ensures that transactions triggering your fixed asset policy are properly reclassified, allowing for accurate tracking of fixed assets and the appropriate calculation of amortization and depreciation over time.

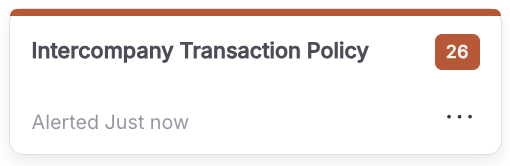

- Inter-company Transaction Policy

How It Works:

This monitor identifies any inter-company transfers posted during a given period.

How to Build:

Set the condition to flag transactions where the transaction type is marked as a transfer.

Why It’s Useful

For multi-entity accounting teams, this monitor is essential for tracking intercompany transactions, such as funds transferred between subsidiary and parent company bank accounts, ensuring proper classification and documentation.

- Office Expenses to be Capitalized

How It Works:

This monitor looks to see if expenses from the office expense account surpass the company’s capitalization threshold.

How to Build:

Set conditions to monitor the office expense accounts. Then, set the amortization threshold.

Why It’s Useful

This monitor helps to identify office expenses that should induce a prepaid expense policy and ensuing capitalization.

- COGS Department Check

How It Works:

This monitor flags any Cost of Goods Sold (COGS) transactions that are not coded to the appropriate department. Since certain departments are tied to certain balance sheet accounts (ex. COGS account should only be with a COGS department), this monitor checks for transactions that don't follow that rule.

How to Build:

Set the condition to identify COGS transactions and ensure they are linked to whatever you have designated as the correct department.

Why It’s Useful

This monitor helps to identify office expenses that should induce a prepaid expense policy and ensuing capitalization.

- Infrequently Used Accounts

How It Works:

This monitor looks for any transaction that’s posted to a company’s infrequently used accounts.

How to Build:

Set the conditions to look at any transactions in the current period from whatever infrequently used account your company has. In this example, an equity account is the infrequently used account.

Why It’s Useful:

If certain accounts in your chart of accounts rarely have entries, then this monitor alerts teams to review any newly posted entries to these accounts.

Next Steps

Add Followers to Monitors

Once you've built our your first few monitors, start assigning them to the most relevant members of your team. You can assign monitors to users in your workspace, giving them alerts via Slack, email, or the in-app inbox. This makes sure the right people see the right alerts at the right time.

Pursue the Proactive Close

Numeric’s transaction monitors are designed to help accounting teams shift from reactive to proactive workflows. By implementing these tools, your team can streamline month-end tasks, gain real-time visibility, and ultimately reduce the manual burden of your financial close.

.png)

.png)

.png)