Understanding Fixed Asset Reconciliation: A Step-by-Step Guide (+ free template!)

.webp)

New office spaces, new tools, and more can often signal exciting times for a company – making these types of long-term investments can follow a business’s existing growth or be the spark plug that moves them forward.

And let’s be honest, who doesn’t like shiny, new things?

These items – buildings, machinery, vehicles, and equipment – are commonly referred to as fixed assets. In order to avoid potential financial misstatements, performing regular fixed asset reconciliation is critical to get right.

What is Fixed Asset Reconciliation?

For the month-end close, fixed asset reconciliation involves comparing the GL trial balance of the fixed asset accounts against the fixed asset subledger total.

If discrepancies arise, adjusting entries are then made to the financial records to reflect the accurate status of fixed assets.

Why is Fixed Asset Reconciliation Important?

If you’ve ever been preparing for a business trip and spent an afternoon rummaging through your things to find that one shirt you were just certain was in your closet, then you’ll instantly understand the importance of fixed asset reconciliation.

Companies need to know exactly what assets they have and where they reside in order to plan for the future. Even more so, they need to know the condition and value of these physical properties so they can decide whether or not to make new purchases.

It’s imperative for businesses – espcially those who have to do any CIP accounting – to accurately assess the value and existence of their assets. Within their useful life, physical assets might get damaged, disposed of, or taken out of operation.

Since assets depreciate over time, getting depreciation calculations right becomes important for knowing how much a fixed asset is worth at any time. If a company gets this part wrong, its financial statements might exaggerate or underestimate value – a clearly misleading error for investors and other interested parties.

Not unlike reconciliation for other accounts, reconciling fixed assets ensures accurate financial reporting, informs financial health, and establishes a degree of audit readiness. As is true across accounting, consistent reconciliation helps to safeguard against financial misrepresentation and its consequences.

How to Manage Fixed Assets Proactively

Compared to more time-intensive reconciliations like accounts payable reconciliation and accounts receivable reconciliation that require poring over hundreds to thousands of invoices, changes in fixed assets are generally much fewer in number. For most companies, it’s unlikely that they will need to establish ongoing recs procedures for fixed assets.

However, to stay on top of fixed asset recs in advance of a full-fledged reconciliation, implementing a consistent review of the fixed asset register can help identify discrepancies as assets are bought and sold.

Even better, if it’s at all possible to close your fixed assets account in the pre-close period, do so in order to alleviate the stress of the close at month/quarter/year-end.

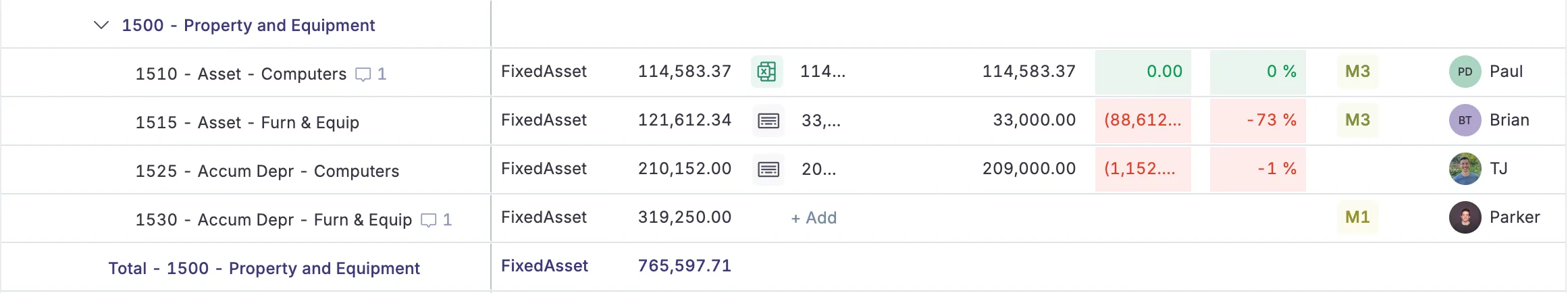

Companies on Numeric implement monitors that automatically flag when a transaction hits an account likely to indicate that a fixed asset needs to be added to the register (think any transaction posted to the GL to the furniture and fixed asset account above $5,000). With ongoing monitors in place, more of fixed asset management can be done across the month, reducing work needed during the close.

What is the Fixed Asset Reconciliation Process?

Fixed asset reconciliation can really refer to two distinct processes.

The first is the physical asset verification that is typically done when prompted by auditors or on an ongoing basis annually/quarterly for some industries.

The second is fixed asset reconciliation done at month-end reconciling the fixed asset subledger total and the trial balance from the GL. We’ll touch on both.

Conducting a Fixed Asset Count or Physical Asset Verification

So, how do you keep up with the location and condition of all your fixed assets? Well, simply put, you go and put your eyes on it.

A slight wrinkle to reconciling fixed assets is that every so often, accounting teams need to confirm the existence and use of their physical properties. This verification process, commonly referred to as a fixed asset count, can vary greatly between industries. Manufacturing, which operates with a host of large machines & equipment, must conduct physical checks on a routine basis.

SaaS companies? In practice, their accounting teams may never do any physical verification – instead, teams like IT are liable to send reports related to any asset disposal or acquisition. While SaaS businesses still use some physical equipment, they typically work with far more intangible assets often accounted for in unique subledgers.

Reconciling Fixed Asset Accounts at Month-End

Deciding when to reconcile fixed assets will differ between businesses – a company with very few fixed assets will probably not need to conduct a reconciliation on a monthly basis and might instead opt for a quarterly or even annual check.

And as companies inch towards audit requirements, reconciliation on a monthly basis becomes the norm.

That said, conducting a fixed asset reconciliation will look roughly the same, no matter the company size. These are the key steps:

1. Compile necessary documents and data

Before starting, collect all records related to fixed assets: purchase invoices, sales receipts for any assets sold, depreciation schedules, and the fixed asset register. Make sure all documents are up to date. This step sets the foundation for a smooth reconciliation process.

Keeping track of physical assets and corresponding workpapers is easier with the use of a fixed asset management tool.

2. Cross-reference the trial balance & totals in fixed asset workpapers

Most reconciliations involve checking some supporting schedule against the general ledger. Fixed assets are no different.

Pull your trial balance for fixed asset account(s) and compare against totals in workpapers. Both new and sold assets should be represented in account journal entries, tie out with the fixed assets register, and be corroborated by invoices and/or receipts.

If using Numeric for account reconciliation, your GL balance and workpaper total will automatically be pulled in, no need to download trial balances. Then you can drill directly into transactions to pinpoint any discrepancies.

At this stage, it’s also necessary to make sure that assets have been properly amortized and depreciated. With depreciation schedules in hand, confirm that asset depreciation aligns with the condition of each item – likewise, ensure that newly purchased items have been accurately amortized and that recently sold physical assets have been registered as liquidated.

3. Addressing discrepancies: adjustments and updates

Should discrepancies arise, be sure to investigate the cause and then account for them: this might include updating the recorded value of an asset, ensuring accumulated depreciation is correct, adding missing assets to the books, or writing off assets that are no longer there.

4. Perform final review

Lastly, see that all prior steps have been thoroughly completed.

Streamline Fixed Asset Reconciliation with Numeric’s Fixed Asset Workpaper Template

Keeping track of fixed assets—especially their acquisition costs, depreciation, and disposals—can be tedious without a structured approach. Numeric’s Fixed Asset Workpaper Template simplifies reconciliation by providing an organized way to store monthly balances, track asset activity, and ensure accurate depreciation calculations.

By using this template, finance teams can:

- Maintain a clear record of asset additions, disposals, and depreciation.

- Easily compare the fixed asset register with the GL trial balance.

- Improve reconciliation efficiency by reducing manual errors and inconsistencies.

Common Challenges in Fixed Asset Reconciliation

Some common challenges businesses may encounter when reconciling fixed assets are:

Incomplete records or poor documentation

Without an accurate record of purchases, sales, or depreciation of assets, it’s virtually impossible to close a fixed assets account. It’s crucial to retain all related supporting documentation, filed in a well-organized way that’s easily accessible.

One recommendation here? Establish a clear, automated workflow with purchase-making teams to ensure all documents are submitted after fixed asset sales/purchases.

Problems arising from asset misclassification

Mistakes happen, and sometimes, assets get put in the wrong account or subledger. For example, an asset that should be a fixed asset might be listed as an inventory item – the inventory account in this case referring to the vendible goods inherent to a company’s business. This misclassification can mess up both the inventory and fixed asset records, making reconciliation tough.

Misclassification isn’t completely preventable, but teams can create monitors in Numeric that alert them if new transactions seem to be erroneously placed across accounts.

Difficulties in tracking depreciation correctly

Getting depreciation wrong means the value of the asset in the books won't match its real valuation. This is a common challenge, especially for companies with many assets that depreciate at different rates.

Need help tracking fixed assets? Download our fixed asset workpaper template to help set up amortization schedules, store monthly account balances, and more.

Manual processes versus automated solutions

Another challenge is the inadequate use of technology in the reconciliation process. Relying on manual methods like cluttered spreadsheets in today's fast-paced environment can be inefficient and error-prone.

Modern accounting software and automation tools can significantly streamline the reconciliation process, reduce errors, and improve efficiency. For corporations and small businesses alike, AI tools are worth consideration in lieu of more expensive measures.

Best Practices for Effective Fixed Asset Reconciliation

Regular updates and maintenance of asset records

Keep your asset records up to date. This means recording new assets as soon as you get them, and noting when you sell or dispose of assets. Regular checks ensure that your records match your actual assets: with Numeric, you can integrate your general ledger to ensure that any and all changes are represented in real-time.

Utilizing technology for tracking and reconciliation

Technology can make tracking and reconciliation easier. Use software that can keep up with purchases, depreciation, and disposals. This can reduce errors and save time.

Training staff on the importance and methods of asset management

Make sure your staff knows how important accurate asset management is. Train them on how to use the software and on the processes for recording asset information. This helps everyone understand their role in keeping accounting records accurate.

Establishing clear policies for asset procurement and disposal

Create rules for buying and getting rid of assets. This includes who approves purchases, how to dispose of assets, and how to record these actions. Clear policies help prevent confusion and ensure consistency in your records.

Following these practices can help you avoid common problems and make fixed asset reconciliation smoother.

Managing Fixed Assets with Numeric's Smart Subledgers

Efficient management of fixed assets is crucial for accurate financial reporting and streamlined operations. Numeric's Smart Subledgers offer an AI-driven solution that automates and simplifies fixed asset management, reducing manual effort and enhancing accuracy.

Key Features of Numeric's Smart Subledgers:

- Automated Transaction Capture: Seamlessly integrate with your general ledger to automatically capture and categorize transactions related to fixed assets, eliminating the need for manual data entry.

- Intelligent Depreciation Scheduling: Utilize AI to apply appropriate depreciation schedules, ensuring compliance and precision without the usual administrative burden.

- Streamlined Journal Entries: Automatically generate and post journal entries for asset acquisitions, disposals, and depreciation directly to your general ledger, maintaining up-to-date financial records effortlessly.

- AI-Assisted Asset Disposals: Leverage AI to handle asset disposals and adjustments by simply describing the event; Numeric's co-pilot will suggest the necessary accounting treatments and entries.

By adopting Numeric's Smart Subledgers, organizations can transition from error-prone manual processes to an automated system that ensures accuracy, compliance, and efficiency in fixed asset management.

Practical Example: Fixed Asset Management & Reconciliation in a SaaS company

The following example will help to illustrate fixed asset reconciliation in action.

Alex is a financial controller at a rapidly growing SaaS company that provides cloud-based solutions for businesses. As part of his responsibilities, Alex is tasked with conducting a reconciliation of fixed assets for the fiscal year ending December 31, 202X.

Here’s how Alex approaches conducting a fixed asset reconciliation.

1. Asset Identification

While SaaS companies predominantly deal with intangible assets, Alex may need to verify the existence and condition of tangible assets such as servers and networking equipment housed in data centers or leased facilities. This involves coordinating with IT and operations teams to perform physical inspections or provide invoices and receipts as needed.

Based on IT’s response, Alex will update the fixed asset register to represent any changes in assets.

2. Matching and Verification

Alex compares the current year's fixed asset register with the previous year's to identify any changes or discrepancies. He investigates significant variances in asset values, additions, disposals, or impairments to ensure they are properly documented and accounted for in accordance with GAAP.

3. Comparative Analysis and Adjustments

Next, he cross-checks the trial balance from the GL against the fixed assets subledger to make sure that balances tie out. In doing so, Alex finalizes that all the data he has reviewed across his financial records aligns. For any discrepancies, he makes adjustments to the GL or subledgers to ensure they align.

4. Documentation and Reporting

Upon completion of the reconciliation process, Alex prepares a reconciliation report detailing his findings, adjustments made, and recommendations for improving asset management practices. This report is eventually shared with senior management and external auditors to ensure transparency and compliance with regulatory requirements.

How Numeric Helps with Fixed Asset Reconciliation

Numeric helps accounting teams manage fast, audit-ready month-end closes with AI and automation. For fixed asset reconciliation, Numeric helps teams:

- Manage balance sheet reconciliations in a single place: For month-end fixed asset recs, teams can pull the account balance total automatically from the workpapers once they’ve linked out to their workpapers. Even better, with a deep ERP integration, Numeric users can click into underlying fixed assets transactions to investigate. Prior period balance monitoring catches any changes since accounts were reconciled.

- Remain organized and audit-ready with clear controls and documentation: Assign reviewers and preparers of fixed asset reconciliation tasks and capture all comments, changes, and task submissions. Auditors then directly log-into Numeric with a clear activity trail, no need for your team to spend hours resurfacing required documentation.

- Report easily on asset transactions and enable FP&A: Pivoting transactions by customer? Grouping by class? Numeric integrates every transaction line from your ERP to enable quick reporting as a part of the month-end close process. With view-only access roles included in all accounts, FP&A teams can check actuals directly in Numeric to monitor how much was spent and monitor cash flow without needing to contact the accounting team prematurely.

- Set-up ongoing transaction monitoring: Say you want to automate alerts for any time a transaction likely needs to be added to the fixed asset register. With monitors, you can flexible set-up ongoing alerts to catch transactions hitting fixed asset accounts to then either expense or add to your register.

FAQ on Fixed Asset Reconciliation

What are the supporting documents for fixed asset reconciliation?

The backup for fixed asset reconciliation includes documents that prove the existence, value, and ownership of the assets. These can be purchase receipts, invoices, depreciation schedules, and insurance records. Keeping these documents organized makes the reconciliation process smoother and supports the accuracy of your financial statements.

What is the journal entry for fixed assets?

The journal entry for recording fixed assets typically involves a debit to the Fixed Asset account and a credit to either Cash or Accounts Payable, depending on how the asset was acquired.

When should you do reconciliation of fixed asset workpapers & the GL vs. when should you do a fixed asset count?

The frequency of your fixed asset reconciliation will depend on your company’s size and fluctuation in fixed assets – even still, it would make sense to reconcile fixed assets monthly alongside most other accounts.

Conversely, conducting a fixed asset count will happen seldom if you’re a SaaS company – maybe annually or only when required from auditors. Other industries, like manufacturing or agriculture, might expect to do a fixed asset count on a more routine basis.

The Bottom Line on Fixed Asset Reconciliation

Fixed asset reconciliation plays a vital role in ensuring the accuracy of a company's financial records. This process is key to accurate financial reporting, compliance with regulations, and strategic planning.

Companies should make fixed asset reconciliation a routine practice. Regular checks, whether monthly, quarterly, or annually, ensure ongoing accuracy and compliance. This habit can save time and resources during financial audits and strategic decision-making processes.

.png)

.png)