What Is the Month End Close Process? Steps, Challenges, and Best Practices

.webp)

Ask 100 accountants to define what is and what isn't involved in the month-end close process, and you'll get nearly 100 unique responses.

We'd know. Our team talks to accountants every day and have run straight into the realization that there isn't a shared definition of what's involved in the month-end close process.

So, we decided it's time to offer a practical perspective, and it's a bit more complicated than the flashcard definition you studied years back.

What is the Month End Close Process? (By the textbook)

Here's the definition that you probably read in textbooks on the month-end close process:

“The month-end close process involves recording and reviewing all financial transactions in the previous month.”

And like most of what you learned from a textbook, that definition falls flat when facing reality on the ground.

Let's face it — your team has limited bandwidth. And like most finance teams, the laundry list of what everyone should be doing on a monthly basis shifts to quarter-end or year-end closes.

Recording and reviewing “all your financial and business transactions” is filled with time-consuming manual processes that make a thorough review, in most cases, unattainable.

Included In The Month-end Close or Not?

Case in point, let's start with some basic accounting procedures. Go ahead and ask a group of accountant friends, which of the following are included in their month-end process?

- Recording stock compensation

- Recognizing revenue

- Depreciating fixed assets

- Identifying software capitalization

All of the above? Some of the above? The standard definition doesn't really give us actionable advice on what really is the month-end close for most businesses.

So here's how we think about it.

Our Definition of The Month-end Close Process

The month-end close process delivers your team accurate and actionable financial data from the preceding month to inform business decisions and adhere to control requirements.

Typically, this involves three steps: data is entered into the system, reconciled properly, and then reviewed to flag anything that may be incorrect.

The finish line of the close process is when the data is locked and ready for reporting, analysis, etc.

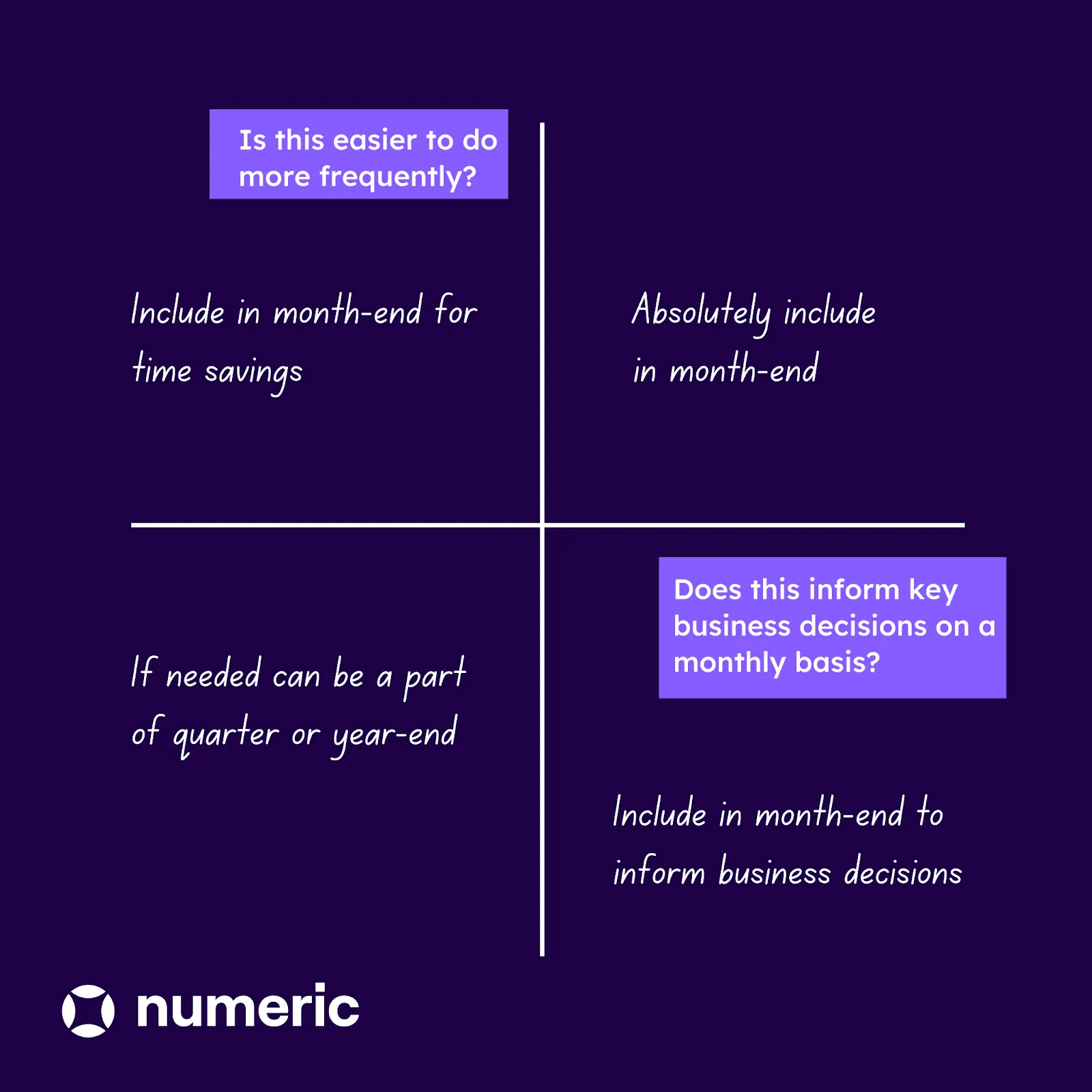

So, taking into account the guiding principle in our definition of accuratefinancial data that’sactionable from the previous accounting period, we use a two-question framework for determining if something should be in the month-end close or if it's just fine pushing out to quarter or year-end.

- Does this inform key decisions being made on a monthly or more frequent basis? Is it actionable

- Is this actually much easier to do frequently? Often due to high transaction volume (think bank recs)

With this framework, all things cash flow and cash burn related immediately jump out as clear month-end close must-haves. But what else is then required in the month-end close process?

Let’s return to our above, slightly more nuanced, examples and see where they fit in:

Example: Revenue Recognition

This one is the most straightforward. Whether you're an early-stage start-up or a public company, revenue drives business decisions and needs to be reflected accurately in your monthly financial statements.

A big yes to the first question in our framework, and it is absolutely a part of a complete month-end close.

Example: Depreciating Fixed Assets

First question, “Does this inform key decisions being made on a monthly or more frequent basis?”.

In many cases, fixed assets are low enough in volume (think of a remote SaaS company) that it may not be material to include in the month-end process when considering business decision impact alone.

But, think of the second question, “Is this actually much easier to do frequently?” The further that time passes, the more challenging it is to round up the right information (serial numbers, cost, etc.) of fixed assets for the company’s balance sheet.

Accounting for fixed assets during the month-end close makes life easier in the long-run. So yes, for most companies, it's a part of a quality month-end close process.

Example: Recording Stock-based Compensation

For many businesses, stock-based comp is low enough in volume that, month to month, the relevant financial data isn't being used to drive business decisions. So, no to our first question.

And compared to accounting for fixed assets or prepaid expenses, it's not too challenging to address stock-based comp at quarter-end — much of the necessary information is likely housed in Carta or a similar tool.

So, according to our framework, if you're a skeleton accounting team trying to create a manageable month-end process, we'd argue that addressing stock-based comp at quarter-end instead of month-end may be the right balance of accuracy and efficiency.

But there's one more complicating factor to keep in mind.

The Boundaries of The Month End Close Expand Over Time

You'll notice our definition of the month-end close process critically includes “adhere to audit requirements”.

When using our two-question framework to think through when to perform accounting procedures, naturally, the last key element is taking into account audit requirements for your organization.

For an early-stage start-up or small business, a complete month-end process will include fewer steps and key accounts, both as a function of the more narrow set of questions you're asking of your accounting data and the less intensive audit requirements.

Companies on the brink of an IPO, on the other hand, will have a much heftier month end close checklist.

Tasks that were previously done at quarter-end, like the stock comp example given above, are brought into the month-end close process.

This dynamic is much of what makes comparing close timelines across companies so challenging.

(And yes, this is permission to ignore your braggadocious CFO friend opining about their 3 day close every time you grab dinner)

5 Key Steps to Follow in the Month-End Close Process

Approaching your month-end close as a sequence of well-defined stages can turn a potentially turbulent period into a more controlled and predictable endeavor.

These steps are more than just a checklist — they are opportunities to solidify accuracy and efficiency within your financial reporting foundation.

Step 1: Getting Your Starting Numbers Straight

The integrity of data flowing from your operational systems — CRM, warehouse, HRIS — is your absolute starting point. Ensure automated data ingestion, via APIs or managed uploads feeding your general ledger, functions flawlessly. This initial phase requires robust pre-close validation routines.

For businesses with varied systems, a consistent staging area for data normalization (uniform formats, mapped accounts) is crucial for reliable automation, preventing the "garbage in, garbage out" trap.

Step 2: Closing Out the Day-to-Day Systems

The smooth flow of your general ledger close depends heavily on the timely and precise closure of these feeder systems. You need clearly defined and consistently enforced cut-off times for all transactional activities. Knowing when AP stops invoice entry or AR finalizes cash application is vital for period integrity.

Beyond just "closing" ERP modules, embed specific validation steps within each sub-ledger’s checklist.

For AP, review unvouchered receipts and check for duplicate payments. For AR, scrutinize unapplied cash and finalize bad debt provision inputs. And for inventory, confirm cycle count reconciliations.

The aim is sequential integrity, ensuring each area is buttoned up.

Step 3: Making Adjustments and Checking Balances

This is where much of the intensive work lies. A risk-based approach to reconciliations is key — not all accounts need identical scrutiny. Categorize accounts by risk and tailor procedures accordingly.

For recurring journal entries like standard accruals, explore rule-based automated creation with built-in calculations and support, all subject to approval.

For complex reconciliations, move beyond simple one-to-one matching to leverage advanced logic for one-to-many scenarios or AI-suggested matches.

All material accruals and accounting estimates demand robust, auditable support, including documented methods and key assumptions, keeping technical standards like ASC 606 or ASC 842 in view.

Step 4: Reviewing the Big Picture and Digging into Changes

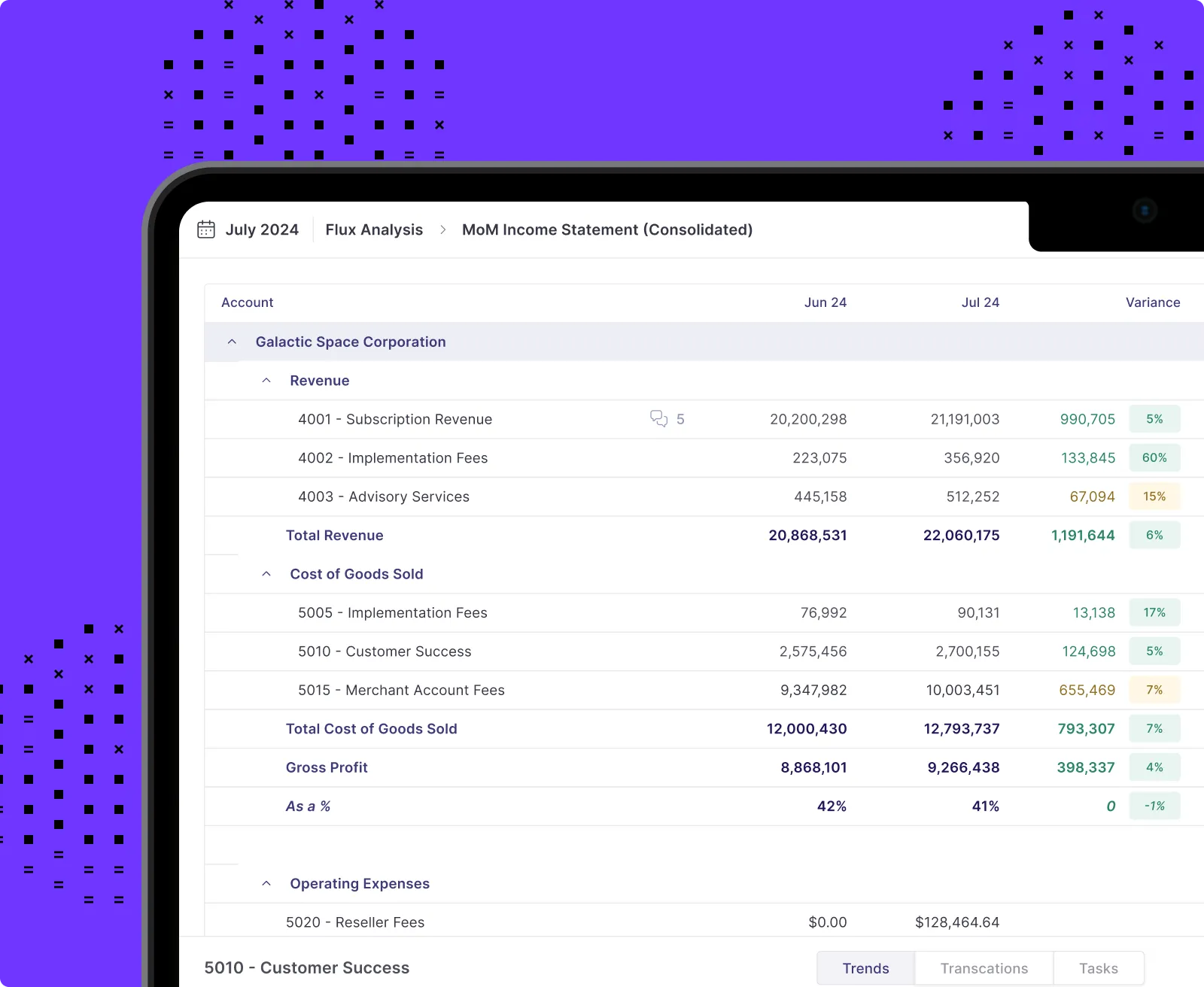

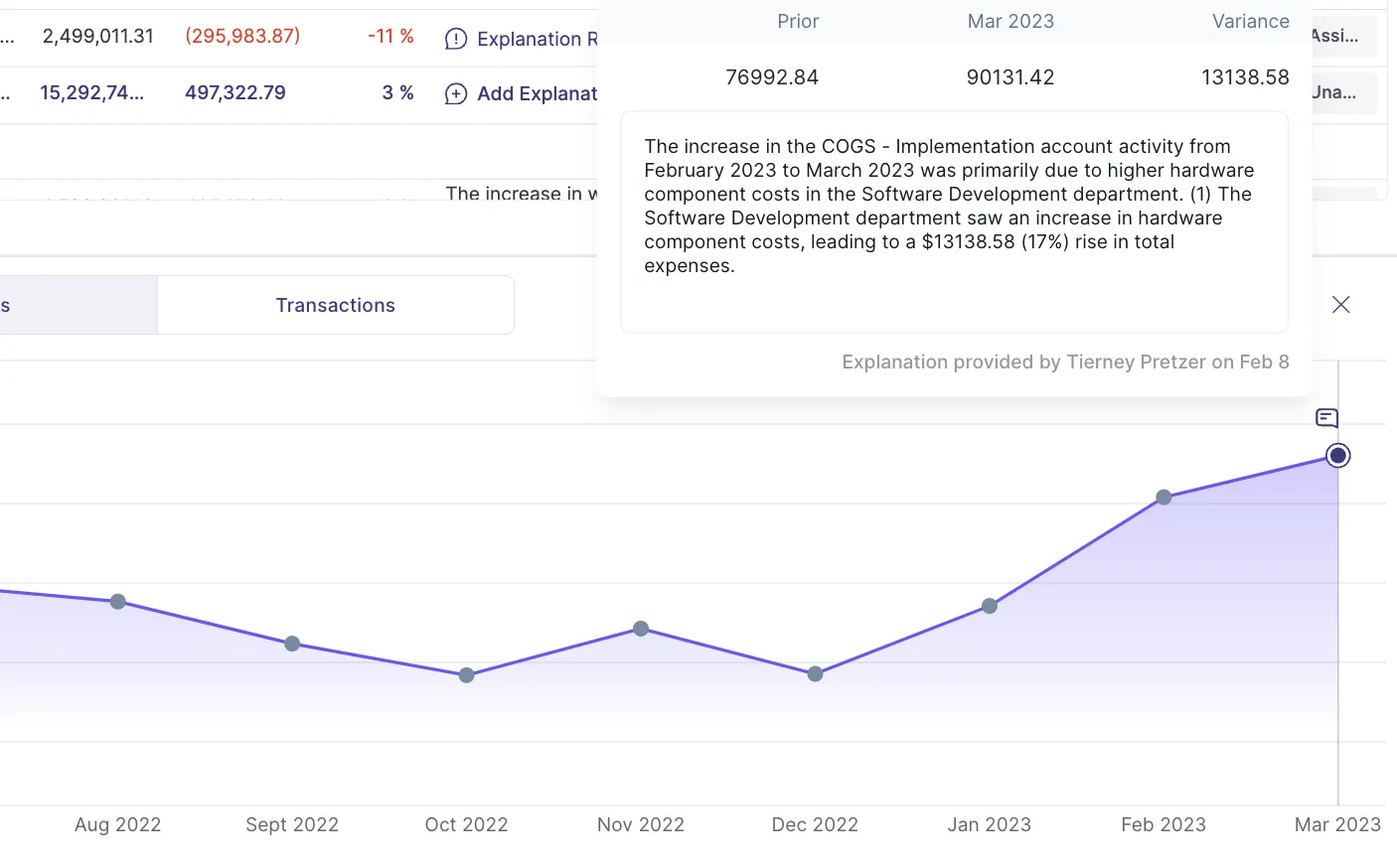

This step is your crucial quality control checkpoint after adjustments. Aim for hierarchical reviews, examining financials not just consolidated, but by entity or department, to catch localized issues. Flux analysis becomes invaluable here, especially if it’s diagnostic.

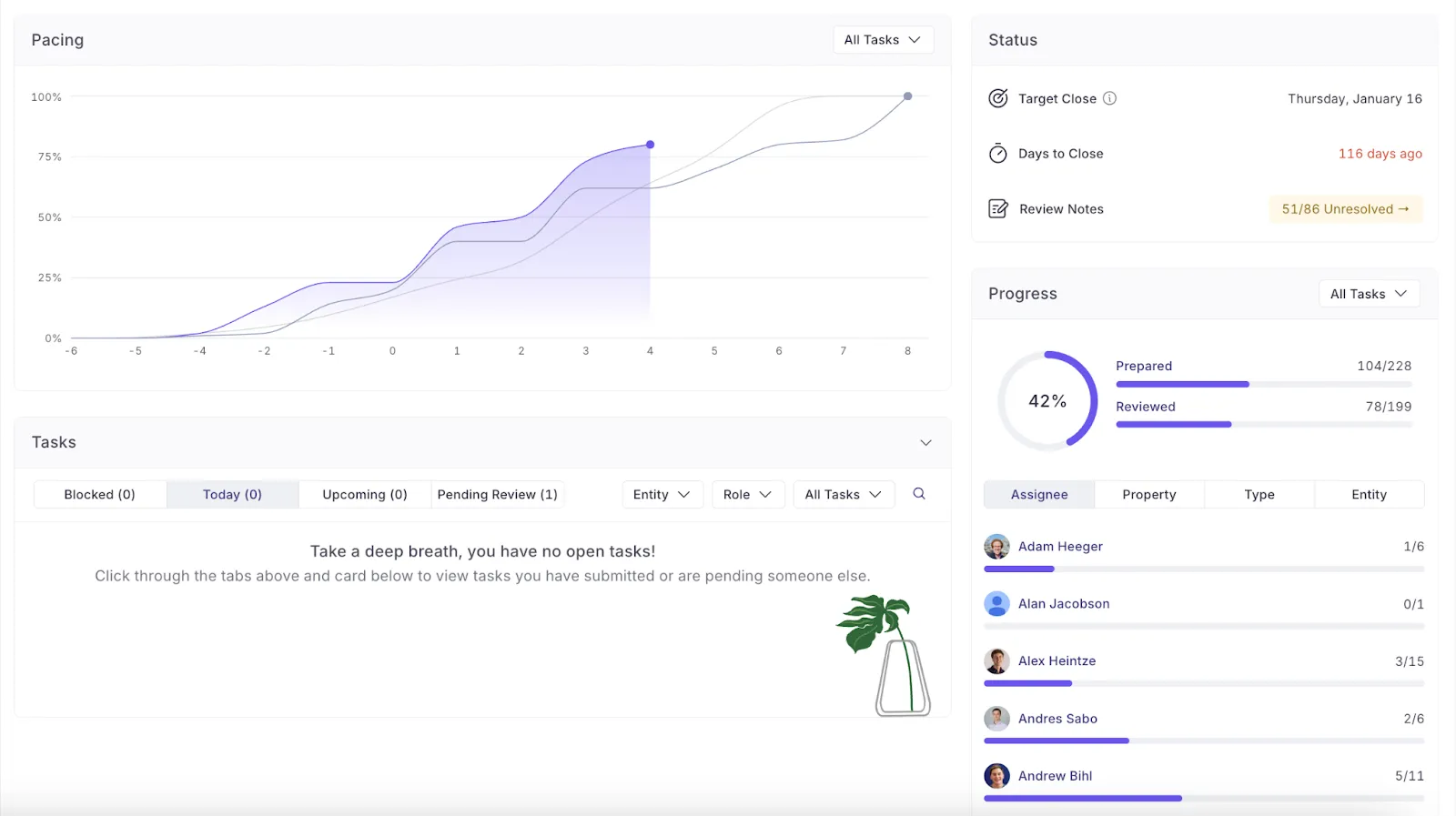

Imagine AI automatically identifying significant variances and drilling into transactions to propose root causes, rather than just noting a percentage change (oh wait, no need to imagine – Numeric can do all of this.)

Also, implement a formal process for tracking and analyzing any adjustments identified after this preliminary close — these often highlight areas for future process improvement.

Step 5: Wrapping Up, Sharing the News, and Learning for Next Time

Finalizing isn't just about locking the period. Leverage tools to automatically generate standard financial reporting packages, perhaps with variance commentary from your flux analysis.

A modern close creates a digital close binder — a centralized, auditable repository for all reconciliations, JEs, and sign-offs, simplifying audits.

Track KPIs related to the close process itself: days to close, number of late adjustments, percentage of automated reconciliations.

Critically, institute a formal post-close review meeting with your team to discuss challenges and identify actionable improvements for the next cycle. This commitment to iteration truly elevates your close.

Top Challenges in the Month End Close & How to Fix Them

You’re likely familiar with the pressures of the month-end close. Many accounting teams navigate similar hurdles, and industry data shows that a staggering 93% of finance professionals feel pressure to close faster.

Recognizing these common pain points is your first step towards effective, modern solutions.

Challenge 1: Juggling Data from Different Systems & Ensuring It's Accurate

Your sales data is in the CRM, inventory in another system, payroll elsewhere, and financials in the ERP. Manually pulling this together, often with error-prone re-keying, consumes valuable time and risks inaccuracies. You might spend more time wrestling data into agreement than performing actual analysis.

The Fix: Bringing It All Together with Smart Tech

Smarter integration is the answer. A centralized close management platform like Numeric with robust API connections can reliably pull data from various sources.

Crucially, such a platform should normalize and validate incoming data against predefined rules before it's used, ensuring consistency and enabling automated system-to-system tie-outs.

Challenge 2: Getting Bogged Down in Spreadsheet Grunt Work

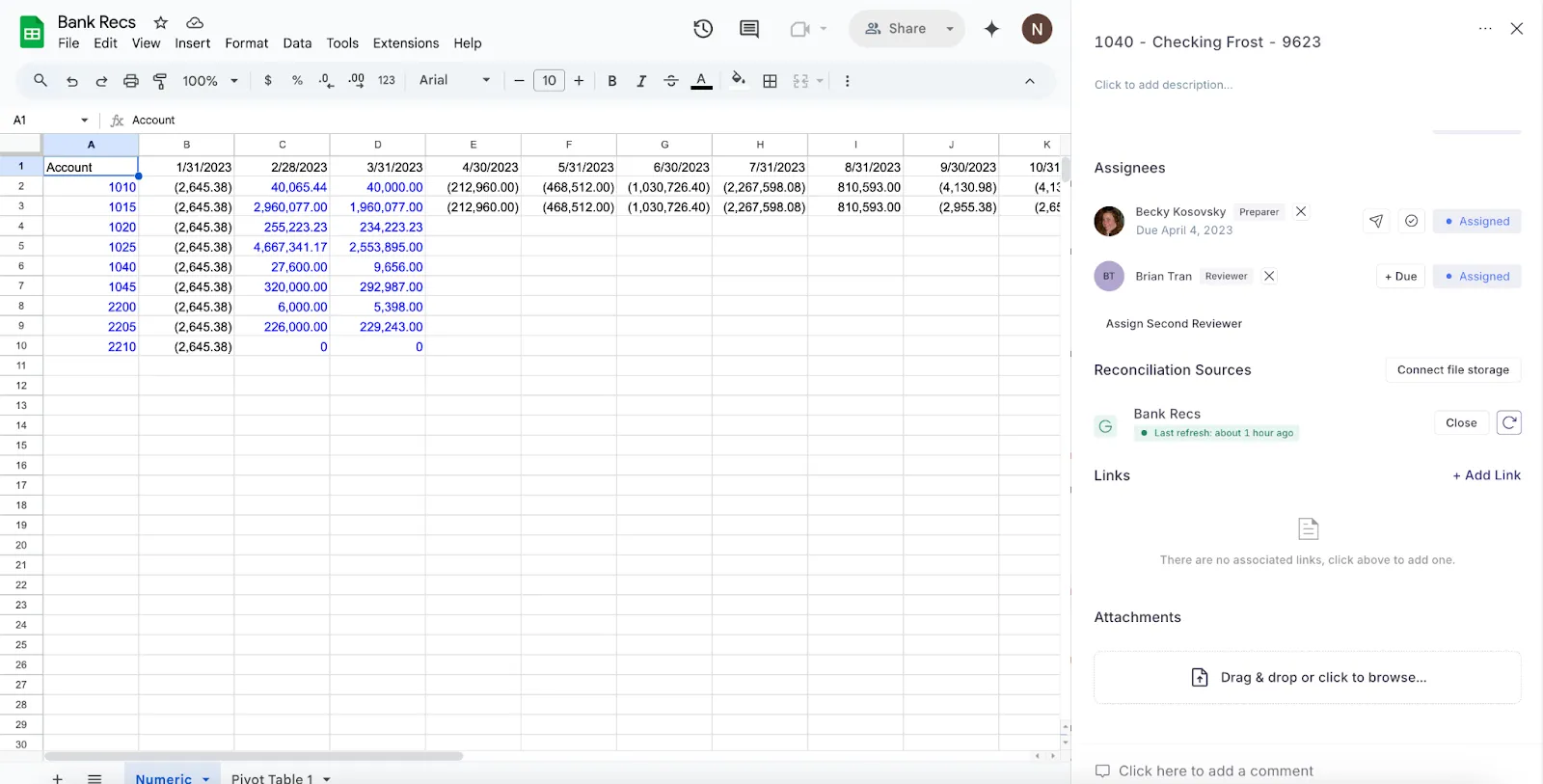

Spreadsheets, while familiar, have limitations for critical close processes like complex reconciliations. Broken formulas, version control issues, and lack of audit trails are common frustrations.

With studies showing a high percentage of spreadsheets contain errors, relying on them for financial accuracy is a significant risk.

The Fix: Using Tools Built Specifically for the Job

AI-powered subledgers like Numeric’s Smart Subledgers are an ideal alternative to standard spreadsheets – teams like 15Five use them to centralize and automate reconciliations for their prepaid expenses.

Also, consider purpose-built reconciliation modules within a dedicated close solution. These offer standardized templates, advanced matching rules, and can automate calculations, all while linking supporting documentation directly.

For flux analysis, integrated tools connecting to GL data can offer AI-driven variance identification and efficient drill-downs.

Challenge 3: Hitting a Wall When Things Get Busier or More Complex

As your company grows — more transactions, entities, or currencies — manual processes become unsustainable. This leads to longer close times, increased error risk, and team burnout.

High-volume bank reconciliations or complex intercompany accounting can particularly accentuate the strain.

The Fix: Smart Scaling with AI and Automation That Grows With You

Technology that handles increased complexity without more manual effort is key. AI-powered high-volume transaction matching for cash or intercompany accounts can process data with speed and accuracy humans can't replicate.

For intercompany work, look for tools that also automate net position calculations and streamline settlement workflows, supported by robust workflow automation for approvals.

Challenge 4: Finding Mistakes Only After They've Wreaked Havoc

Too often, the close becomes a hunt for errors already made, leading to rework and increased risk. This reactive mode is stressful and undermines confidence in the numbers.

You're constantly putting out fires rather than preventing them.

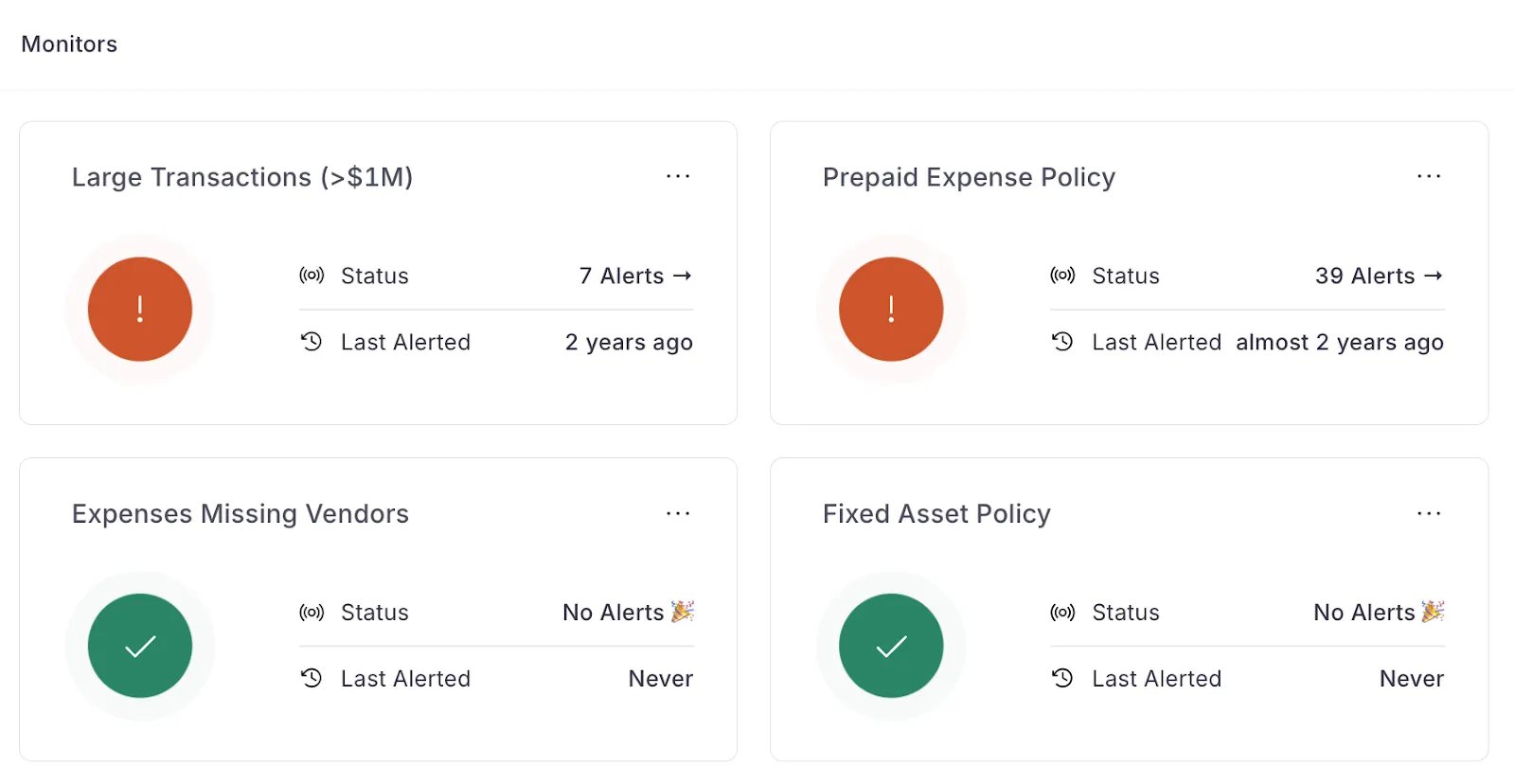

The Fix: Catching (and Preventing) Issues Before They Become Big ProblemsShift to a more preventive control environment. Apply Continuous Controls Monitoring principles, using technology to automate control execution and documentation as transactions occur.

Numeric’s Transaction Monitors assist in monitoring transactional data throughout the month, flagging unusual patterns or policy violations before month-end. Like Saved Searches in NetSuite, teams can configure rules unique to their business that trigger alerts whenever a discrepancy appears.

Challenge 5: Feeling Disconnected, Chasing People, and Drowning in Review Cycles

Without a clear, real-time view, it's hard for managers to know the close status or identify bottlenecks. Team members might work in silos, and reviews via emailed spreadsheets make tracking comments and resolutions difficult.

This inefficiency slows things down and lets errors slip through.

The Fix: Working Smarter, Together, with Clear Views for Everyone

A centralized close task management dashboard provides real-time visibility into status, ownership, and bottlenecks.

Numeric’s close tooling allows teams to keep track of all close motions in one place.

With integrated collaboration features, your team can have contextual discussions on tasks, creating an auditable history. Role-based access and standardized review workflows also ensure consistency and clear evidence of review.

Now, a Tricky One: Is Flux Analysis Included In the Month-end Close?

Flux analysis is particularly divisive.

As teams use Numeric to easily perform flux analysis on their underlying ERP data, we’ve seen firsthand that some folks include flux squarely as a month-end close activity and others situate it as a post-close task.

Our take: it depends on why you’re doing the flux.

Is flux analysis helping your team ensure accurate, actionable financial data?

If flux is used to pinpoint missing accruals or ensure completeness, verdicts in: it’s a part of the month-end close process.

Instead, if flux is an analytical procedure that’s more about providing commentary and reporting: it’s squarely a post-close activity.

Month-End Close vs. Quarter-End Close: Spotting the Key Differences

You perform your month-end close regularly, but quarter-end often brings a noticeable shift in intensity. While the fundamental aim — accurate financial information — is constant, the scope, depth, and scrutiny can change significantly.

Understanding these nuances helps you plan resources and manage expectations effectively.

Bottom Line on The Month-end Close

Determining the right month-end process is largely about striking the right balance between speed and accuracy.

And what’s included in month-end versus year-end or quarter-end, is context dependent, dictated by transaction volume, how financial data is used, and your company stage.

While the exact set of steps will differ, across all businesses, the north star of the month-end close should be a set of processes that guarantee the delivery of accurate and actionable financial data.

Working towards a faster, more accurate month-end close? Start for free organizing and adding visibility to your close process with Numeric.

Frequently Asked Questions (FAQ)

What's the main goal of the month-end close?

The main goal for your month-end close is straightforward: get timely and reliable accurate financial data. This gives you a trustworthy snapshot of the company's financial health each month by focusing on core financial activity.

Having these key numbers helps management make smarter short-term strategic decisions. It also properly sets the stage so you can efficiently prepare financial statements, like the income statement and balance sheet, when quarter-end and year-end roll around.

How do we decide which tasks are truly monthly vs. quarterly?

Deciding what really needs doing monthly boils down to practicality and impact.

Ask yourself two things about each potential close task: First, does the information it produces actually drive key monthly strategic decisions or operational adjustments?

Second, is it much easier or significantly riskier not to handle this task frequently? Think about avoiding a time consuming quarterly catch-up, especially with high-volume transactions or tricky manual processes.

Tasks hitting 'yes' on either question usually belong in your core monthly closing process.

What are some examples of tasks that are almost always essential for month-end?

While every company differs slightly, certain tasks are almost always vital for a meaningful month-end. Key account reconciliation usually tops the list – specifically, making sure your cash balance (including tracking petty cash) matches bank records, and reconciling core subledgers like accounts receivable (tied to invoice payments) and accounts payable.

Other general activities include accurately recording incoming cash, posting significant known monthly expenses, and booking critical accruals like payroll or interest on bank loans.

How can a checklist help manage this monthly vs. quarterly approach?

Think of your month end close checklist as the practical definition of your specific monthly scope. It's invaluable for clearly assigning tasks and setting deadlines as you approach the closing date. Holding a quick pre-close meeting to walk through the monthly checklist keeps everyone aligned.

Using a checklist brings helpful standardization to financial data collection (or collecting data) efforts each month. It promotes consistency in your core reconciliation process, which is fundamental for creating reliable numbers and helping to mitigate fraud risks.

The month-end close is a vital rhythm, yet it often sparks questions. Let's address some common queries you might have.

How long should the month-end close process take?

While top performers aim for under 5 days, the ideal time varies by company size, complexity, and automation. A small business might close in 2-3 days, while a complex, manual one could take 15+.

The real goal is speed to accurate, reliable data, not just speed itself. Leading firms use continuous accounting and intelligent automation to distribute tasks, reducing period-end peaks.

How can businesses speed up the month-end close process?

Work smarter, not just faster. Here are a few ways to do so:

- Simplify your chart of accounts and adopt a risk-based approach, focusing efforts on material areas.

- Aggressively automate high-volume, rule-based tasks like bank recs.

- "Shift left" by performing tasks continuously with technology.

- Centralize workflow with a dedicated close platform and use AI for complex areas like flux analysis.

What is the difference between month-end and quarter-end close?

Quarter-end typically demands greater rigor. You'll use lower materiality thresholds, meaning more scrutiny for smaller items. Complex estimates like income tax provisions (ASC 740) get extensive validation.

For public companies, preparing the 10-Q involves detailed disclosures and footnote preparation not typical of monthly filings, often with direct external auditor involvement.

How can automation improve the month-end close process?

Automation enhances accuracy and control. It reduces manual data errors and uses AI for complex reconciliation matching, flagging only true exceptions.

It ensures consistent journal entry creation with built-in approvals. Centralized platforms streamline task management, while AI makes variance analysis proactive by suggesting root causes, freeing accountants for strategic work.

What are the risks of an inefficient month-end close process?

An inefficient close risks financial misstatements, impaired decision-making from unreliable data, and compliance failures with penalties. Expect higher audit costs and scrutiny as a result.

Operationally, it can delay payroll or vendor payments, elevate fraud risk, and erode investor confidence. Internally, it leads to team burnout and attrition.

.png)

.png)

.png)